TVS Motor Share Price Target: The headquarter of TVS Motor is located in Chennai. TVS stands for Thirukkurungudi Vengaram Sundaram, and the company was founded in 1911 by T.V. Sundaram Iyengar. Over the years, TVS has grown its business not only within India but also in the international markets.

In 1999, TVS Motor was listed on the Bombay Stock Exchange (BSE). Since then, the price of TVS Motor shares has increased significantly, and as of now, they are actively traded. The company manufactures around four million vehicles annually.

TVS Motor vehicles are popular among customers for their fuel efficiency. The company has also set up a manufacturing plant for two-wheelers in Hosur. Below is the projected share price target for TVS Motor from 2025 to 2030.

TVS Motor Company Overview

| Company Name | TVS Motor Company Limited |

| Founded | 1911 |

| Headquarters | Chennai |

| Industry | Automotive |

| Chairman | Venu Srinivasan |

| Stock Exchange Listing | NSE & BSE |

| Official Website | tvsmotor.com |

TVS Motor Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹1,08,825.83 Cr. |

| ROE | 30.23% |

| ROCE | 33.78% |

| P/E | 46.93 |

| P/B | 12.26 |

| Div. Yield | 0.35% |

| Book Value | ₹186.86 |

| Face Value | ₹1 |

| EPS (TTM) | ₹48.81 |

| 52 Week High | ₹2,958.15 |

| 52 Week Low | ₹1,873.05 |

Also Read: Kalyan Jewellers Share Price Target

TVS Motor Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 392.30B | 22.24% |

| Operating Expense | 99.63B | 28.24% |

| Net Income | 16.86B | 26.92% |

| Net Profit Margin | 4.30 | 3.86% |

| Earnings Per Share | 35.50 | 13.13% |

| EBITDA | 52.61B | 34.96% |

| Effective Tax Rate | 34.20% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 25.44B | 23.28% |

| Total Assets | 422.20B | 19.83% |

| Total Liabilities | 347.09B | 18.37% |

| Total Equity | 75.11B | — |

| Shares Outstanding | 475.09M | — |

| Price to Book | 15.95 | — |

| Return on Assets | 7.52% | — |

| Return on Capital | 9.43% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 16.86B | 26.92% |

| Cash from Operations | -12.53B | 71.56% |

| Cash from Investing | -10.01B | 23.43% |

| Cash from Financing | 27.59B | -54.91% |

| Net Change in Cash | 5.05B | 24.44% |

| Free Cash Flow | -7.35B | 67.10% |

Also Read: Spicejet Share Price Target

TVS Motor Share Price Target From 2025 to 2030

| Year | Target Price |

|---|---|

| TVS Motor Share Price Target 2025 | ₹2,580 |

| TVS Motor Share Price Target 2026 | ₹3,740 |

| TVS Motor Share Price Target 2027 | ₹5,050 |

| TVS Motor Share Price Target 2028 | ₹6,565 |

| TVS Motor Share Price Target 2029 | ₹7,767 |

| TVS Motor Share Price Target 2030 | ₹9,500 |

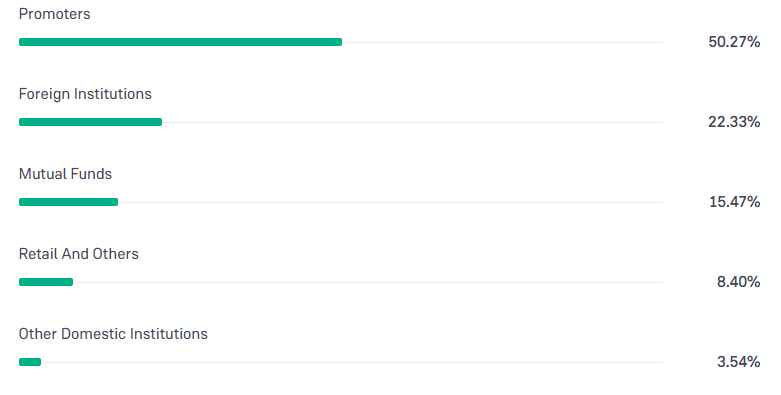

TVS Motor Shareholding Pattern

- Retail & Other: 8.40%

- Promoters: 50.27%

- Foreign Institutions: 22.33%

- Mutual Funds: 15.47%

- Other Domestic Institutions: 3.54%

Also Read: Netweb Technologies Share Price Target

TVS Motor Competitors/Peer Companies

- Eicher Motors

- Hero MotoCorp

- Ola Electric Mobility

- Wardwizard Innovations & Mobility

- Urja Global

- Tunwal E-Motors

- Bikewo Green Tech

Also Read: Mastek Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

I am a content writer with over 6 years of experience in the finance sector, holding an MBA and CFA. I enjoy providing accurate insights on market trends and investment strategies.