Dr Agarwal Healthcare Share Price Target 2025: Given the recent IPO listing and growing presence, Dr Agarwal’s Healthcare is making a name for itself in the eye care industry. Are you wondering how their stock price could evolve by 2025?

This detailed analysis explores potential price movements, backed by expert predictions and key market indicators. Whether you are an investor looking to make informed decisions or just curious to learn about stock market trends, join us as we dive into Dr Agarwal’s Healthcare stock price target forecast for 2025.

Dr Agarwal Healthcare Company Overview

| Company Name | Dr Agarwal Healthcare Ltd. |

| Founded | 2010 |

| Headquarters | Chennai, Tamil Nadu |

| Industry | Eye-care services provider |

| Chairman | Amar Agarwal |

| Stock Exchange Listing | NSE & BSE |

| Official Website | dragarwal.com |

Dr Agarwal Healthcare Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹2,824.18 Cr. |

| ROE | 34.28% |

| ROCE | 38.59% |

| P/E | 55.94 |

| P/B | 15.35 |

| Div. Yield | 0.08% |

| Book Value | ₹391.57 |

| Face Value | ₹10 |

| EPS (TTM) | ₹107.43 |

| 52 Week High | ₹7,300 |

| 52 Week Low | ₹2,541.80 |

Also Read: Pidilite Industries Share Price Target

Dr Agarwal Healthcare Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 2.59B | -35.77% |

| Operating Expense | 175.11M | -9.85% |

| Net Income | 68.47M | -28.14% |

| Net Profit Margin | 2.65 | 11.81% |

| Earnings Per Share | — | — |

| EBITDA | 170.08M | -24.47% |

| Effective Tax Rate | 27.34% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 13.74M | 561.53% |

| Total Assets | 4.44B | 29.48% |

| Total Liabilities | 671.59M | -35.83% |

| Total Equity | 3.76B | — |

| Shares Outstanding | 1.39B | — |

| Price to Book | 1.11 | — |

| Return on Assets | 2.10% | — |

| Return on Capital | 2.38% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 68.47M | -28.14% |

| Cash from Operations | 1.20B | 31.14% |

| Cash from Investing | -2.03B | -249.28% |

| Cash from Financing | 826.03M | 302.48% |

| Net Change in Cash | 2.42M | 103.28% |

| Free Cash Flow | 1.20B | 73.39% |

Also Read: Cyient Share Price Target

Dr Agarwal Healthcare Share Price Target 2025 (January to December)

| Years | Months | Target Price |

|---|---|---|

| Dr Agarwal Healthcare Share Price Target 2025 | January | ₹6,060 |

| Dr Agarwal Healthcare Share Price Target 2025 | February | ₹6,164 |

| Dr Agarwal Healthcare Share Price Target 2025 | March | ₹6,282 |

| Dr Agarwal Healthcare Share Price Target 2025 | April | ₹6,379 |

| Dr Agarwal Healthcare Share Price Target 2025 | May | ₹6,400 |

| Dr Agarwal Healthcare Share Price Target 2025 | June | ₹6,493 |

| Dr Agarwal Healthcare Share Price Target 2025 | July | ₹6,596 |

| Dr Agarwal Healthcare Share Price Target 2025 | August | ₹6,702 |

| Dr Agarwal Healthcare Share Price Target 2025 | September | ₹6,799 |

| Dr Agarwal Healthcare Share Price Target 2025 | October | ₹6,890 |

| Dr Agarwal Healthcare Share Price Target 2025 | November | ₹7,000 |

| Dr Agarwal Healthcare Share Price Target 2025 | December | ₹7,101 |

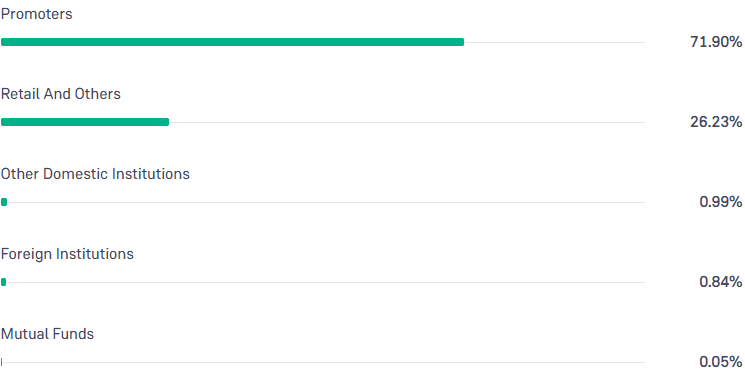

Dr Agarwal Healthcare Shareholding Pattern

- Retail & Other: 26.23%

- Promoters: 71.90%

- Foreign Institutions: 0.84%

- Mutual Funds: 0.05%

- Other Domestic Institutions: 0.99%

Also Read: Vikas EcoTech Share Price Target

Dr Agarwal Healthcare Competitors/Peer Companies

- Max Healthcare

- Apollo Hospitals

- Fortis Healthcare

- Global Health

- Narayana Hrudayalaya

- Aster DM Healthcare

- KIMS

- Rainbow Children

- Jupiter Life Line

- Healthcare Global

Also Read: BEML Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.