Bank of Baroda Share Price: Investing in stocks requires a well-informed decision backed by research and expert analysis. If you are considering Bank of Baroda shares, this article provides valuable information about Bank of Baroda share price targets from 2025 to 2030. Our assessment focuses on the bank’s growth, overall performance, and future prospects, helping you make an informed investment choice.

Bank of Baroda Company Overview

Bank of Baroda is one of India’s largest public sector banks, offering a wide range of banking and financial services. Established in 1908, it has evolved into a global player with a strong domestic presence and a significant international footprint.

The bank has an extensive network of branches and ATMs in India and abroad. Its services include personal banking, corporate banking, international banking, treasury services, and rural banking, catering to diverse customer needs.

| Company Name | Bank of Baroda Ltd. |

| Founded | 1908 |

| Headquarters | Vadodara, Gujarat |

| Industry | Banking |

| CEO | Debadatta Chand |

| Stock Exchange Listing | NSE & BSE |

| Official Website | bankofbaroda.in |

Bank of Baroda Fundamental Analysis

- Market Cap: ₹1,06,064.64 Cr.

- ROE: 16.91%

- ROCE: 16.18%

- P/E Ratio: 5.46

- P/B Ratio: 0.81

- Div. Yield: 3.71%

- Book Value: ₹253.39

- Face Value: ₹2

- EPS (TTM): ₹37.55

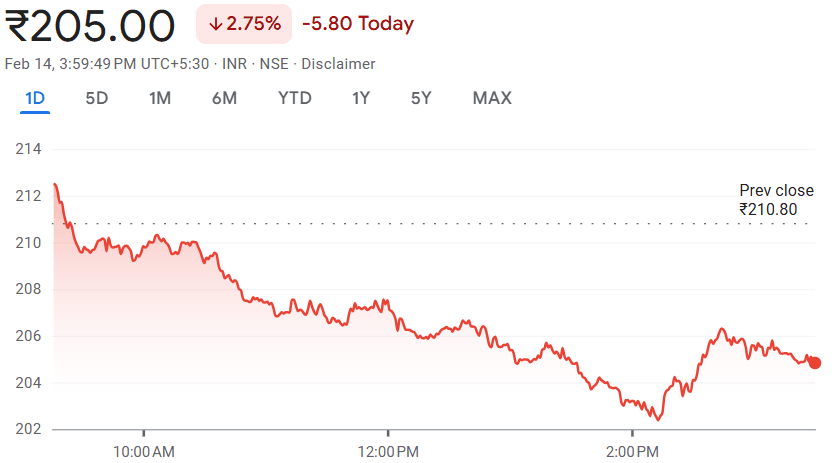

- 52 Week High: ₹298.45

- 52 Week Low: ₹202.25

Also Read: Oil India Share Price Target

Bank of Baroda Share Price Chart

Bank of Baroda Share Price Target 2025 to 2030

| Year | Share Target |

|---|---|

| Bank of Baroda Share Price Target 2025 | ₹298 |

| Bank of Baroda Share Price Target 2026 | ₹325 |

| Bank of Baroda Share Price Target 2027 | ₹347 |

| Bank of Baroda Share Price Target 2028 | ₹360 |

| Bank of Baroda Share Price Target 2029 | ₹386 |

| Bank of Baroda Share Price Target 2030 | ₹447 |

Also Read: Future Consumer Share Price Target

Bank of Baroda Target Price 2025: ₹298

By 2025, Bank of Baroda’s share price is projected to reach ₹298. This target reflects the bank’s steady performance and its efforts to strengthen its position in the banking sector. For investors, this could be an opportunity to benefit from its consistent growth and focus on digital transformation.

Bank of Baroda Target Price 2026: ₹325

In 2026, Bank of Baroda’s share price is expected to rise to ₹325. This growth indicates the bank’s ability to improve its asset quality and expand its customer base. Investors with a medium-term horizon might find this target appealing, but it’s essential to monitor economic conditions and banking sector trends.

Bank of Baroda Target Price 2027: ₹347

The year 2027 could see Bank of Baroda’s share price climb to ₹347. This target highlights the bank’s potential to deliver stable returns, supported by its operational efficiency and strategic initiatives. Long-term investors may view this as a sign of sustained growth in the financial sector.

Bank of Baroda Target Price 2028: ₹360

By 2028, Bank of Baroda’s share price is projected to reach ₹360. This increase underscores the bank’s ability to maintain a strong balance sheet and adapt to changing market dynamics. Investors should stay updated on the bank’s performance and broader economic developments.

Bank of Baroda Target Price 2029: ₹386

In 2029, Bank of Baroda’s share price is expected to hit ₹386. This target reflects the bank’s potential to achieve consistent growth, driven by its focus on innovation and customer-centric services. For investors, this could be a promising phase in their investment journey.

Bank of Baroda Target Price 2030: ₹447

Looking ahead to 2030, Bank of Baroda’s share price is projected to reach ₹447. This target signifies the bank’s strong growth trajectory and its ability to create long-term value for shareholders. However, investors should remain cautious and consider factors like interest rate changes and regulatory policies.

Also Read: GG Engineering Share Price Target

Bank of Baroda Shareholding Pattern

- Retail & Other: 9.00%

- Promoters: 63.97%

- Foreign Institutions: 8.91%

- Mutual Funds: 9.58%

- Other Domestic Institutions: 8.54%

Bank of Baroda Key Competitors/Peer Companies

- SBI

- PNB

- Indian Overseas Bank

- Canara Bank

- Union Bank of India

- Indian Bank

- UCO Bank

- Bank of India

- Central Bank of India

- Bank of Maharashtra

Also Read: Borosil Renewables Share Price Target

To connect with us, click on any of the given social media buttons.

FAQs

Is Bank of Baroda a good share to buy?

Yes, Bank of Baroda is a good share to buy.

Is Bank of Baroda safe for investment?

Yes, Bank of Baroda is safe for investment.

Will Bank of Baroda share price increase?

Yes, Bank of Baroda share will increase.

Is Bank of Baroda a strong Bank?

Yes, Bank of Baroda is a strong bank.

Is Bank of Baroda undervalued or overvalued?

Bank of Baroda is Undervalued.

Disclaimer: The information in this article is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

We have more than 5 years of experience in the stock market and analysis, and we are dedicated to delivering accurate, real-time market updates and insightful analysis. With a sharp eye on the Indian and global stock markets, we simplify complex financial data and trends to help investors make informed decisions.