GVK Power Share Price: GVK Power and Infrastructure Ltd. is a major player in India’s energy sector, established in 2005. The company’s core objective is to provide sustainable energy solutions, which include thermal & hydroelectric power plants. Additionally, GVK is also investing in infrastructure projects, such as airports and roads, which enhances its growth potential.

In this article, we will look at the key factors impacting GVK Power’s Share Price, market trends, and target price for the next few quarters. If you are an investor, this analysis will be important for you.

GVK Power Company Overview

| Company Name | GVK Power & Infrastructure Ltd. |

| Founded | 2005 |

| Headquarters | Secunderabad, Andhra Pradesh |

| Industry | Energy, airports, hospitality, transportation, real estate, pharmaceuticals, and technology |

| CEO | Gunapati Venkata Krishna Reddy |

| Stock Exchange Listing | NSE & BSE |

| Official Website | gvk.com |

GVK Power Fundamental Analysis

- Market Cap: ₹664.85 Cr.

- ROE: -2.08%

- ROCE: -1.18%

- P/E Ratio: 0

- P/B Ratio: 0.78

- Div. Yield: 0%

- Book Value: ₹5.42

- Face Value: ₹1

- EPS (TTM): ₹-0.14

- 52 Week High: ₹13.54

- 52 Week Low: ₹4.21

Also Read: HFCL Share Price Target

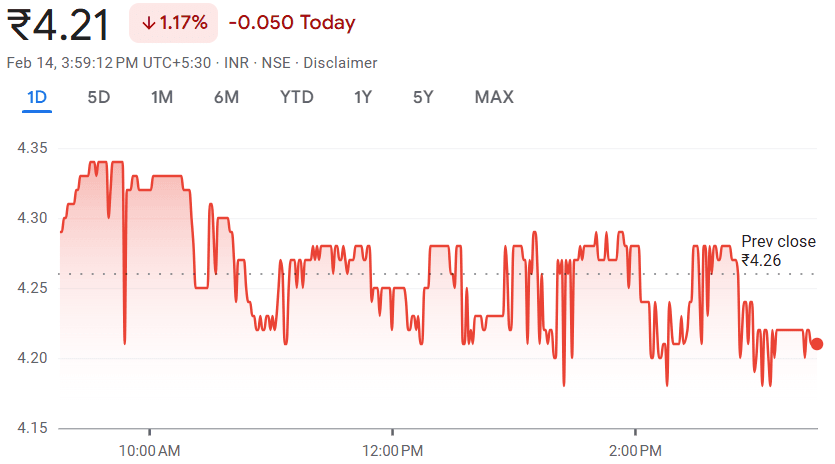

GVK Power Share Price Chart

GVK Power Share Price Target 2025 to 2030

| Year | Share Target |

|---|---|

| GVK Power Share Price Target 2025 | ₹6.90 |

| GVK Power Share Price Target 2026 | ₹9.10 |

| GVK Power Share Price Target 2027 | ₹10.80 |

| GVK Power Share Price Target 2028 | ₹13.00 |

| GVK Power Share Price Target 2029 | ₹15.20 |

| GVK Power Share Price Target 2030 | ₹18.30 |

Also Read: Kellton Tech Share Price Target

GVK Power Target Price 2025

GVK Power’s Share Price Target can reach 6.90 INR in 2025. The government is spending a lot of money on infrastructure development for solar power energy, which is benefiting many companies because companies are getting very good projects. The government is also making policies in support of the company so that they can develop the best infrastructure by providing good funding.

GVK Power Target Price 2026

GVK Power’s Share Price Target is expected to increase to 9.10 INR by 2026. The company is reducing its operation efficiency and cost, due to which there is a good improvement in the company, and the company’s profit is increasing. By finding good ways with the help of investment and technology, the company is improving waste and resource management, which gives investors confidence that the company can grow well in the coming times.

GVK Power Target Price 2027

GVK Power is expected to reach its Share Price Target of 10.80 INR in 2027. The company completes most of its projects on time, due to which the company’s reputation is improving in the market and they are offered many projects, then the investor gets more confidence in the company and the company starts growing.

GVK Power Target Price 2028

By 2028, GVK Power’s Share Price Target can increase to 13.00 INR. As you all know that there is a lot of demand for urbanization in India, with the help of which demand is being seen in the energy sector of India and all this demand is being met by the companies mostly by using solar power, in which GVK Power’s name also comes. The company’s share price may go up in the coming time

GVK Power Target Price 2029

By 2029, GVK Power’s Share Price Target may be 15.20 INR. If we look at the financial results of the company, then very good growth is being seen in the company’s revenue and the company is growing well through profitability. There is a positive sentiment in the stock market towards the company and many investors are investing money in this company.

GVK Power Target Price 2030

By 2030, GVK Power’s Share Price Target may increase to 18.30 INR. The company has increased the buyback and dividend payout, due to which the company is signalling that their performance is going to be very good in the coming time, which will also benefit the investors.

Also Read: HBL Power Share Price Target

GVK Power Shareholding Pattern

- Retail & Other: 45.07%

- Promoters: 54.25%

- Foreign Institution: 0.19%

- Mutual Funds: NA

- Other Domestic Institutions: 0.49%

GVK Power Limited Competitors

- HFCL

- L&T

- Waaree Renewables

- Techno Electric

- Acme Solar Holdings

- Sterling

- Reliance Infrastructure

- Engineers India

- ISGEC Heavy Engineering

- Va Tech Wabag

Also Read: Amara Raja Batteries Share Price Target

To connect with us, click on any of the given social media buttons.

FAQs

Is GVK Power a good buy?

Yes, GVK Power is a good buy.

Is GVK power debt-free?

No, GVK Power is not debt-free.

Is GVK Power a government company?

No, GVK Power is not a govt. company.

What is GVK’s full form?

Gunupati Venkata Krishna.

Is GVK an Indian company or not?

Yes, it is an Indian company.

Disclaimer: The information in this article is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

We have more than 5 years of experience in stock market and analysis, and we are dedicated to delivering accurate, real-time market updates and insightful analysis. With a sharp eye on the Indian and global stock markets, we simplify complex financial data and trends to help investors make informed decisions.

Disclaimer: The stock market updates shared by DateUpdateGo are solely for general information and learning purpose only. They are not meant to serve as an investment advice. Individuals should always seek guidance from a certified financial advisor before making any investment-related choices.