In this article, we’ll explore JSW Infrastructure share price targets for the years 2025, 2026, 2027, 2028, 2029, and 2030, providing insights into its growth potential and market performance. A major player in India’s port operations and maritime services, JSW Infrastructure Limited has attracted the attention of both domestic and international investors.

JSW Infrastructure Company Overview

A subsidiary of the renowned JSW Group, JSW Infrastructure was established in 2006 and is headquartered in Mumbai. The company focuses on developing and operating strategic infrastructure, especially ports, to facilitate seamless business operations. It specializes in importing and exporting essential commodities such as coal, iron ore, and oil, leveraging state-of-the-art technology and facilities.

Beyond port operations, JSW Infrastructure plays a vital role in integrated logistics, including transportation and warehousing. The company is also involved in developing infrastructure for industrial ventures, such as special economic zones (SEZs) and industrial parks. By enhancing trade efficiency and supporting economic growth, JSW Infrastructure has become a critical contributor to India’s development.

JSW Infrastructure Fundamental Analysis

- Market Cap: ₹53,518.54 Cr.

- ROE: 9.75%

- ROCE: 9.55%

- P/E Ratio: 130.15

- P/B Ratio: 10.64

- Div. Yield: 0.21%

- Book Value: ₹23.95

- Face Value: ₹2

- EPS (TTM): ₹1.96

- 52 Week High: ₹361

- 52 Week Low: ₹211.55

Also Read: JSW Energy Share Price Target

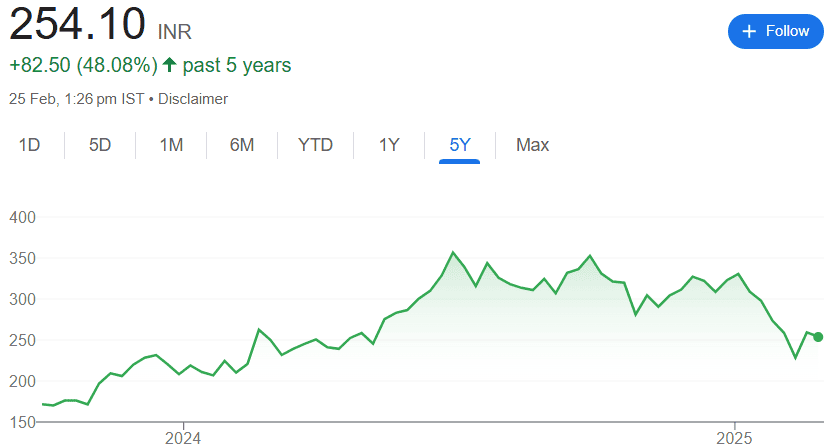

JSW Infrastructure Share Price Chart

JSW Infrastructure Share Price Target 2025 to 2030

| Year | Target Price |

|---|---|

| JSW Infrastructure Share Price Target 2025 | ₹330 |

| JSW Infrastructure Share Price Target 2026 | ₹400 |

| JSW Infrastructure Share Price Target 2027 | ₹480 |

| JSW Infrastructure Share Price Target 2028 | ₹550 |

| JSW Infrastructure Share Price Target 2029 | ₹640 |

| JSW Infrastructure Share Price Target 2030 | ₹740 |

Also Read: Empower India Share Price Target

JSW Infrastructure Target Price 2025: ₹330

JSW Infrastructure’s share price is expected to reach ₹330 by 2025, driven by its strong presence in the infrastructure and logistics sector. The company’s focus on expanding its port operations and improving operational efficiency will likely contribute to this growth, making it a promising option for investors.

JSW Infrastructure Target Price 2026: ₹400

By 2026, the stock price could rise to ₹400, reflecting JSW Infrastructure’s ability to capitalize on India’s growing infrastructure needs and its commitment to sustainable development. Strategic investments and favorable government policies will further support this upward trend.

JSW Infrastructure Target Price 2027: ₹480

In 2027, the share price is projected to hit ₹480, supported by JSW Infrastructure’s expansion into new markets and its focus on enhancing port capacity and efficiency. The company’s dedication to growth and innovation will drive long-term progress.

JSW Infrastructure Target Price 2028: ₹550

By 2028, the share price may reach ₹550, as JSW Infrastructure continues to strengthen its position as a leader in the infrastructure and logistics sector. Its ability to adapt to market demands and deliver value-added services will be key factors in achieving this target.

JSW Infrastructure Target Price 2029: ₹640

The share price is expected to climb to ₹640 by 2029, driven by JSW Infrastructure’s consistent performance and strategic investments in high-growth areas. The company’s focus on scalability and customer satisfaction will further enhance its growth prospects.

JSW Infrastructure Target Price 2030: ₹740

By 2030, JSW Infrastructure’s share price could soar to ₹740, reflecting its long-term growth potential in the infrastructure and logistics industry. The company’s commitment to innovation, sustainability, and global expansion will be critical in achieving this milestone.

Also Read: Tata Chemicals Share Price Target

JSW Infrastructure Shareholding Pattern

- Retail & Other: 7.58%

- Promoters: 85.62%

- Foreign Institutions: 4.07%

- Mutual Funds: 1.91%

- Other Domestic Institutions: 0.81%

JSW Infrastructure Key Competitors/Peer Companies

- CDSL

- GMR Airports

- Sagility India

- MCX

- NBCC (India)

- CAMS

- International Gem & Jewellery

- Embassy Developments

- KFin Technologies

- Onesource Specialty

Also Read: Rashtriya Chemicals and Fertilizers – RCF Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this article is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.