Oberoi Realty Share Price: Oberoi Realty Limited (OBEROIRLTY) operates in the Real Estate – Development industry, it is part of the Real Estate sector.

In this detailed post, we will explore OBEROIRLTY’s stock price targets for 2025, 2026 and 2030. Using various technical analysis approaches and machine learning models trained on past performance, we will forecast these targets.

Known for its significant presence in the Indian stock market, Oberoi Realty has displayed various trends over the years. We will discuss OBEROIRLTY’s current market position, its growth path and how its price performance may be affected by external market factors until 2030.

Oberoi Realty Company Overview

| Company Name | Oberoi Realty Ltd. |

| Founded | 1998 |

| Headquarters | Mumbai |

| Industry | Real Estate |

| Chairman | Vikas Oberoi |

| Stock Exchange Listing | NSE & BSE |

| Official Website | Oberoi Realty |

Oberoi Realty Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹64,177.61 Cr. |

| ROE | 11.90% |

| ROCE | 13.63% |

| P/E | 29.91 |

| P/B | 4.5 |

| Div. Yield | 0.45% |

| Book Value | ₹391.99 |

| Face Value | ₹10 |

| EPS (TTM) | ₹59.01 |

| 52 Week High | ₹2,349.80 |

| 52 Week Low | ₹1,273.50 |

Also Read: PNB Housing Finance Share Price Target

Oberoi Realty Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 22.07B | 24.17% |

| Operating Expense | 5.15B | 28.31% |

| Net Income | 1.72B | 39.15% |

| Net Profit Margin | 7.80 | 12.07% |

| Earnings Per Share | — | — |

| EBITDA | 2.94B | 74.38% |

| Effective Tax Rate | 18.08% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 473.00M | 141.82% |

| Total Assets | 15.82B | 16.63% |

| Total Liabilities | 12.85B | 6.67% |

| Total Equity | 2.96B | — |

| Shares Outstanding | 239.10M | — |

| Price to Book | 80.47 | — |

| Return on Assets | 11.73% | — |

| Return on Capital | 22.54% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 1.72B | 39.15% |

| Cash from Operations | 1.92B | 119.09% |

| Cash from Investing | -569.50M | -51.58% |

| Cash from Financing | -1.07B | -68.18% |

| Net Change in Cash | 277.40M | 267.61% |

| Free Cash Flow | 413.63M | 147.49% |

Also Read: IndiaMART Share Price Target

Oberoi Realty Share Price – Target 2025 to 2030

| Year | Target Price |

|---|---|

| Oberoi Realty Share Price Target 2025 | ₹2,074.03 |

| Oberoi Realty Share Price Target 2026 | ₹2,496.11 |

| Oberoi Realty Share Price Target 2027 | ₹3,038.42 |

| Oberoi Realty Share Price Target 2028 | ₹3,622.35 |

| Oberoi Realty Share Price Target 2029 | ₹4,318.11 |

| Oberoi Realty Share Price Target 2030 | ₹4,997.47 |

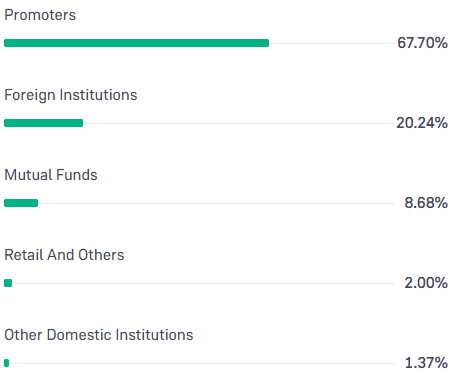

Oberoi Realty Shareholding Pattern

- Retail & Other: 2.00%

- Promoters: 67.70%

- Foreign Institutions: 20.24%

- Mutual Funds: 8.68%

- Other Domestic Institutions: 1.37%

Also Read: Hindalco Share Price Target

Oberoi Realty Competitors/Peer Companies

- DLF

- Macrotech Developers

- Prestige Estates Projects

- Sobha

- Ashiana Housing

- PSP Projects

Also Read: Schneider Electric Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.