If you invest in the stock market, you must know the PGInvIT share price targets for 2025, 2026, 2027, 2028, 2029, and 2030. Here, you will get detailed information regarding all your queries, such as its fundamentals, shareholdings, financial performance, future predictions, and more.

PGInvIT Company Overview

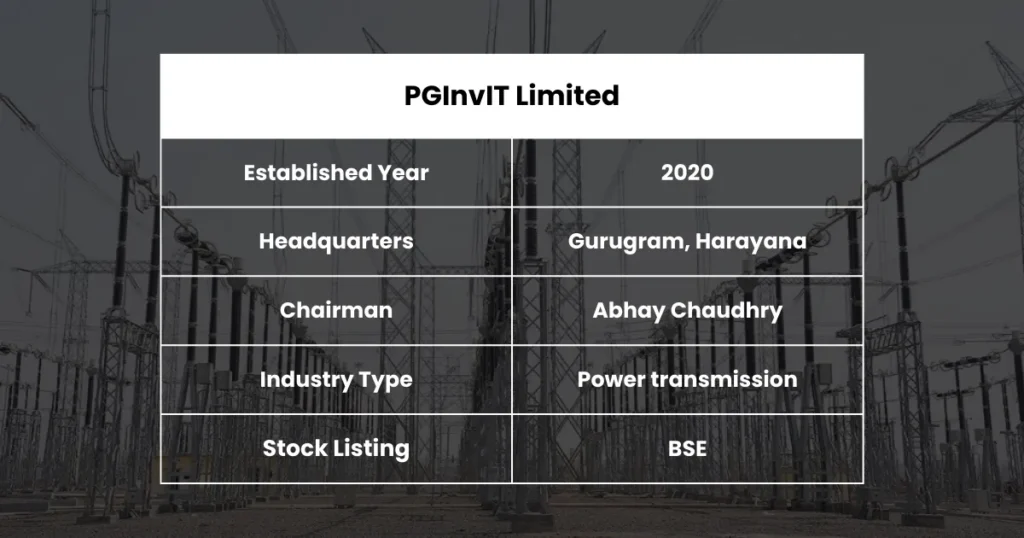

PowerGrid Infrastructure Investment Trust (PGInvIT), established in 2020 by Power Grid Corporation of India Limited (PGCIL), is a key player in India’s power transmission sector. Headquartered in Gurugram, India, PGInvIT operates as an infrastructure investment trust (InvIT) that manages high-voltage transmission assets across the country.

The Trust owns and operates 11 power transmission lines spanning approximately 3,699 circuit kilometres, as well as three substations with a total transformation capacity of 6,630 MVA.

Led by Chairman Abhay Chaudhry, PGInvIT focuses on ensuring efficient and reliable power transmission, which contributes significantly to India’s energy infrastructure. The Trust is publicly listed on BSE, providing investors an opportunity to participate in the growth of the power sector.

PGInvIT Fundamental Analysis

- Market Cap: ₹6,881 Cr.

- ROE: 13.1%

- ROCE: 12.8%

- P/E Ratio: 8.11

- P/B Ratio: 0.89

- Dividend Yield: 3.96%

- Book Value: ₹31.45

- Face Value: ₹1

- EPS (TTM): ₹9.33

- 52-Week High: ₹100

- 52-Week Low: ₹75

Also Read: Havells Share Price Target

PGInvIT Share Price Target 2025

After analyzing PGInvIT’s past price trends and market performance, it is estimated that the stock could reach ₹79.80 by early 2025.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹84.92.

By the end of 2025, PGInvIT’s share price can achieve the target of ₹88.10.

| Month | Target Price |

|---|---|

| January | ₹81.66 |

| February | ₹80.02 |

| March | ₹78.75 |

| April | ₹79.80 |

| May | ₹81.10 |

| June | ₹82.45 |

| July | ₹83.75 |

| August | ₹84.92 |

| September | ₹85.85 |

| October | ₹86.68 |

| November | ₹87.45 |

| December | ₹88.10 |

PGInvIT Share Price Target 2026

After analyzing PGInvIT’s past price trends and market performance, it is estimated that the stock could reach ₹88.65 by early 2026.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹92.30.

By the end of 2026, PGInvIT’s share price can achieve the target of ₹96.50.

| Year 2026 | Target Price |

|---|---|

| Beginning | ₹88.65 |

| Middle | ₹92.30 |

| End | ₹96.50 |

PGInvIT Share Price Target 2027

After analyzing PGInvIT’s past price trends and market performance, it is estimated that the stock could reach ₹97.20 by early 2027.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹105.10.

By the end of 2027, PGInvIT’s share price can achieve the target of ₹112.75.

| Year 2027 | Target Price |

|---|---|

| Beginning | ₹97.20 |

| Middle | ₹105.10 |

| End | ₹112.75 |

Also Read: Shriram Finance Share Price Target

PGInvIT Share Price Target 2028

After analyzing PGInvIT’s past price trends and market performance, it is estimated that the stock could reach ₹114.30 by early 2028.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹122.85.

By the end of 2028, PGInvIT’s share price can achieve the target of ₹130.40.

| Year 2028 | Target Price |

|---|---|

| Beginning | ₹114.30 |

| Middle | ₹122.85 |

| End | ₹130.40 |

PGInvIT Share Price Target 2029

After analyzing PGInvIT’s past price trends and market performance, it is estimated that the stock could reach ₹132.10 by early 2029.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹140.20.

By the end of 2029, PGInvIT’s share price can achieve the target of ₹148.50.

| Year 2029 | Target Price |

|---|---|

| Beginning | ₹132.10 |

| Middle | ₹140.20 |

| End | ₹148.50 |

PGInvIT Share Price Target 2030

After analyzing PGInvIT’s past price trends and market performance, it is estimated that the stock could reach ₹150.80 by early 2030.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹162.10.

By the end of 2030, PGInvIT’s share price can achieve the target of ₹170.25.

| Year 2030 | Target Price |

|---|---|

| Beginning | ₹150.80 |

| Middle | ₹162.10 |

| End | ₹170.25 |

Also Read: Rural Electrification Corporation—REC Share Price Target

Powergrid Infrastructure Investment Trust – PGINVIT Share Price Target & Forecast 2025 To 2030

| Year | Target Price |

|---|---|

| 2025 | ₹88.10 |

| 2026 | ₹96.50 |

| 2027 | ₹112.75 |

| 2028 | ₹130.40 |

| 2029 | ₹148.50 |

| 2030 | ₹170.25 |

PGInvIT Shareholding Pattern

- Retail & Other: 57.37%

- Promoters: 15.00%

- Foreign Institution: 18.97%

- Mutual Funds: 4.17%

- Other Domestic Institutions: 4.49%

Also Read: Bajaj Auto Share Price Target

PGInvIT Income Statement

PGInvIT reported slightly lower revenue of ₹12.65 billion, down 2.16% over the year-ago period, indicating a marginal decline in income. However, net income grew 574.92% to ₹9.27 billion due to improved margins and operating efficiency.

Net profit margin improved to 73.23% (+585.29%), indicating strong profitability. EBITDA stood at ₹11.66 billion (-3.18%), indicating stable operating performance. The effective tax rate was 10.37%, indicating efficient tax management.

PGInvIT Balance Sheet

PGInvIT’s total assets stood at ₹99.83 billion, a marginal decline of 0.60%, indicating stable asset management. Total liabilities increased by 5.24% to ₹18.05 billion, while total equity remained strong at ₹81.77 billion, ensuring financial stability.

Return on assets (ROA) is 5.31%, and return on capital (ROC) is 6.03%, indicating good returns on investments. The company has ₹5.61 billion in cash and short-term investments, up 9.71% over the previous year, ensuring liquidity.

PGInvIT Cash Flow

PGInvIT’s cash from operations grew by 4.18% to ₹12.30 billion, reflecting stable cash flows. Cash from investments turned positive at ₹102.19 million (+106.65%), indicating controlled capital expenditure.

Cash from financing was negative at -₹11.82 billion, reflecting debt repayments or dividend distributions. Net change in cash grew 134.63% to ₹582.79 million, ensuring liquidity for future needs. Free cash flow grew 1.54% to ₹8.48 billion, reflecting strong cash generation.

Also Read: Subex Share Price Target

PGInvIT Key Competitors

- NTPC

- Adani Power

- Power Grid Corp

- Adani Green Energy

- Tata Power

- Adani Energy Solutions

- NTPC Green Energy

- NHPC

- JSW Energy

- Torrent Power

PGInvIT Share Price Target FAQ

-

Is PGInvIT a good investment?

Yes, PGInvIT is a good investment.

-

What is the target of Powergrid Infra Share 2025?

The target of Powergrid Infra share 2025 is ₹88.10

-

What is the target of Powergrid Infra Share 2030?

The target of Powergrid Infra share 2030 is ₹170.25

-

Is PGInvIT a government company?

Yes, PGInvIT is a government company.

-

Is PGInvIT overvalued or undervalued?

PGInvIT is slightly overvalued.

Also Read: Triveni Turbine Share Price Target

Disclaimer: The information in this article is for educational purposes only, and market analysts give the targets mentioned in it as suggestions. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

Disclaimer: The stock market updates shared by DateUpdateGo are solely for general information and learning purpose only. They are not meant to serve as an investment advice. Individuals should always seek guidance from a certified financial advisor before making any investment-related choices.