In today’s article, we are going to tell you what will be the upcoming Prakash Steelage Share Prediction 2025 to 2030, 2040, 2050 according to analysts.

October Update: Prakash Steelage Limited is trading up 7.77% at ₹9.02 from its previous closing price. The company is trading in a price range of ₹9.15 to ₹8.14. Prakash Steelage Limited stock has fallen -13.37% this year and a decline of -5.75% has been seen in the last 5 days. The company has earned a net profit of Rs 0.08 crore in its last quarter.

Some of the listed peers of Prakash Steelage Limited include KIC Metaliks Limited (up 3.28%), INDSIL Hydro Power and Manganese Limited (up 6.91%), and Prakash Steelage Limited (up 7.77%).

Prakash Steelage Ltd Company Overview

If we tell you about the company, then their mission is to provide high quality stainless steel solutions to their clients so that it can emerge as a leading brand in the manufacturing & export industry.

The company also has a commitment to sell its products in quality standard condition with innovation and excellence so that their company can have a good position in the market.

Prakash Steelage is a very good brand in the steel industry. In terms of products, it sells things related to heat exchanger, evaporator, heater element, pump, condenser, from which it earns a good amount of revenue.

| Company Name | Prakash Steelage Ltd. |

| Founded | May 19, 1894 |

| Headquarters | Mumbai |

| Industry | Indian steel industry |

| CEO | Prakash Kanugo |

| Stock Exchange Listing | NSE & BSE |

| Official Website | prakashsteelage.com |

Prakash Steelage Limited Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹145.25 Cr. |

| ROE | 0% |

| ROCE | 0% |

| P/E | 3.93 |

| P/B | 18.62 |

| Industry P/E | 19.32 |

| Debt to Equity | 0.04 |

| Div. Yield | 0% |

| Book Value | ₹0.45 |

| Face Value | ₹1 |

| EPS (TTM) | ₹2.11 |

| 52 Week High | ₹16.20 |

| 52 Week Low | ₹5.30 |

Also Read: Tejas Network Share Price Target

Prakash Steelage Limited Financials

Income Statement

| METRIC | 2024 | Y/Y CHANGE |

|---|---|---|

| Revenue | 45.85M | – |

| Operating expense | -57.29M | -3,949.87% |

| Net income | 92.67M | +17.97% |

| Net profit margin | 202.14 | — |

| Earnings per share | — | — |

| EBITDA | 97.40M | +6,584.49% |

| Effective tax rate | 0.06% | — |

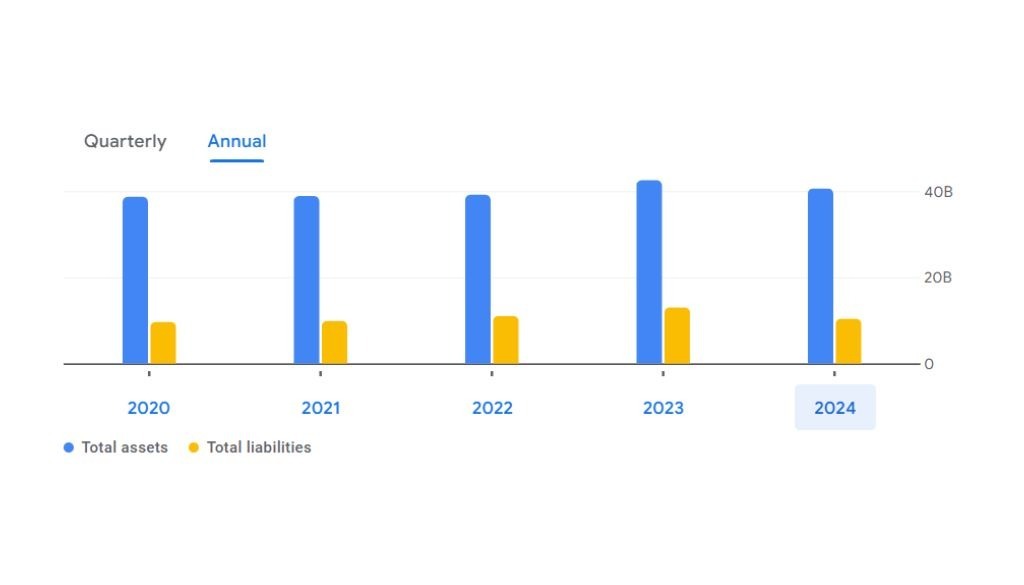

Balance Sheet

| METRIC | 2024 | Y/Y CHANGE |

|---|---|---|

| Cash and short-term investments | 2.76B | -7.26% |

| Total assets | 40.59B | -4.52% |

| Total liabilities | 10.35B | -20.21% |

| Total equity | 30.24B | — |

| Shares outstanding | 179.08M | — |

| Price to book | 1.03 | — |

| Return on assets | 5.05% | — |

| Return on Capital | 6.05% | — |

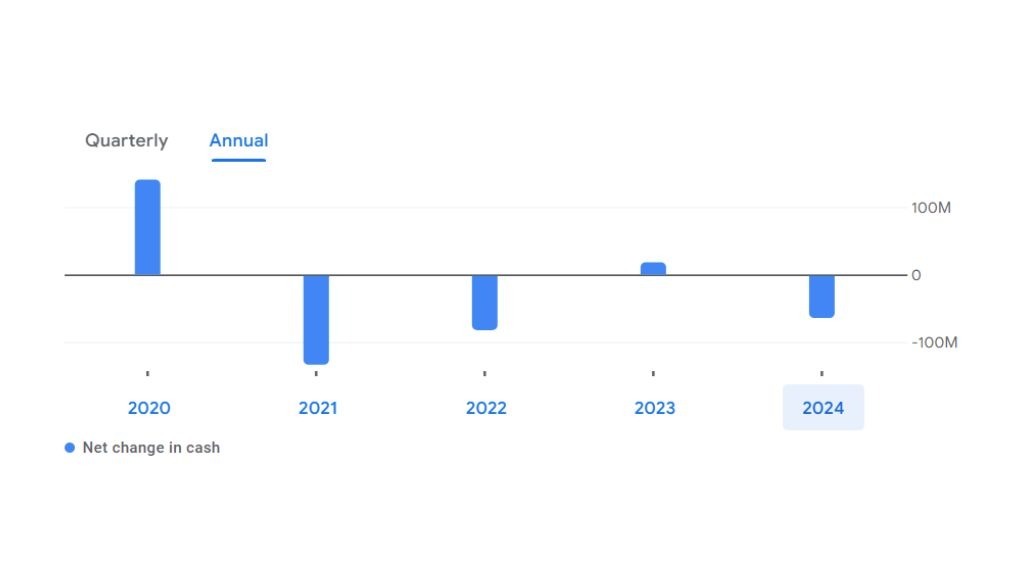

Cash Flow

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Net income | 3.48B | +82.79% |

| Cash from operations | 6.01B | +2.80% |

| Cash from investing | -3.20B | +41.33 |

| Cash from financing | -2.88B | -659.01% |

| Net change in cash | -62.30M | -442.31% |

| Free cash flow | -496.43M | -124.44% |

Also Read: Microcap Mutual Fund

Prakash Steelage Share Price Target 2025 to 2030, 2040, 2050

| Year | Target Price |

|---|---|

| Prakash Steelage Share Price Target 2025 | ₹10.77 |

| Prakash Steelage Share Price Target 2026 | ₹14.25 |

| Prakash Steelage Share Price Target 2027 | ₹21.03 |

| Prakash Steelage Share Price Target 2028 | ₹23.46 |

| Prakash Steelage Share Price Target 2029 | ₹36.01 |

| Prakash Steelage Share Price Target 2030 | ₹50.12 |

| Prakash Steelage Share Price Target 2040 | ₹101.25 |

| Prakash Steelage Share Price Target 2050 | ₹204.10 |

Prakash Steelage Limited Shareholding Pattern

- Retail & Others: 66.45%

- Promoters: 33..55%

- Foreign Institutions: 0.00%

- Mutual Funds: 0.00%

- Other Domestic Institutions: 0.00%

Prakash Steelage Limited Competitors

- Sarda Energy

- NMDC Steel

- Gallantt Ispat

- Mishra Dhatu Nigam

- Sunflag Iron

- Goodluck India

- Salasar Techno

- Interarch Building Products

- Pennar Industries

- Aeroflex Industries

Also Read: Ashoka Buildcon Share Price Target

Prakash Steelage Limited Products List

Prakash Steelage Limited offers a wide variety of Stainless Steel Products which are designed and manufactured by different companies as per their requirements such as –

- S.S Welded Tube: This tube is made from premium stainless-steel. It is manufactured to withstand corrosion and high temperatures. This product is manufactured on a large scale for various industries as it is a very long lasting and strong product.

- S.S Welded Pipes: This pipe is known for its strength and adaptability. The pipe is manufactured using modern welding techniques. This pipe can be used to withstand high pressure and high temperature.

- S.S Large Diameter Pipes (EFW): This pipe is used for large fluid volumes. It is used in large industries for oil and gas and the welding process is done using Electric Fusion Welding (EFW) process as these large diameter pipes have outstanding mechanical properties.

- U-Bending Tube: This tube is customized as per different industries so that you can transfer heat easily with its help. This tube is mostly used for Heat Exchanger and Condenser. It is made in different shapes for thermal performance.

- S.S Grades: The company offers an array of stainless steel grades including 304, 316 and 321, each of which is designed to suit specific environmental and performance requirements, ensuring the perfect fit for every application.

Also Read: WhiteOak Mutual Fund

Application use of Prakash Steelage Limited

Heat Exchanger

Prakash Steelage’s stainless steel welded tubes and pipes play a vital role in the manufacture of heat exchangers, these products are valued for their excellent thermal conductivity and resistance to oxidation at high temperatures.

This makes them ideal for use in power plants due to its high steam generation and cooling systems which ensure smooth transfer of heat to the power plant. In the Chemical Process Industry, these tubes and pipes help maintain precise temperature control during chemical reactions, ensuring safety and efficiency.

Evaporators

Evaporators are a stainless steel product manufactured by Prakash Steelage. It transfers heat smoothly and protects the fluid contained in it from corrosion. It is mostly required in the food and beverage industry as it is used for concentrated juices and liquids. Stainless Steel prevents corrosion of equipment and also ensures that the product lasts for a long time.

Also Read: BOI Mutual Fund Returns History

Conclusion

Today we have given you complete information about Prakash Steelage Share Price Target in Hindi so that you can make good profit in the coming time. For this, it is very important for you to take advice from your financial advisor because this company can make a lot of profit in the coming time.

FAQs

-

Is it good to buy Prakash Steelage Share?

Yes.

-

Is Prakash Steelage debt free?

Yes, it is almost debt free.

-

Is Prakash Steelage share good or bad?

Good, but before investing, consult your financial advisor.

-

What is the share price target for Prakash Steelage in 2025?

10.77 INR.

-

What is the Prakash Steel share price target 2030?

50.12 INR.

To connect with us, click on the Facebook or WhatsApp button given below.

Disclaimer: The information given in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company