Schneider Electric Share Price: Schneider Electric Infrastructure Limited focuses on bridging the gap between progress and sustainability by maximizing energy and resource efficiency. This year, we will forecast the stock price of Schneider Electric Infrastructure Limited (SCHNEIDER) by 2030 using a machine learning approach based on historical data. Known for its strong market presence, this company has shown consistent trends over the past few years. In this analysis, we will explore SCHNEIDER’s current market position, growth trajectory, and potentially influential external factors.

This serve the industries such as IT, telecommunication infrastructure and operations. Focusing on enclosures, card frames, and accessories, the company’s diverse offering helps maintain a strong market position. Schneider maintains an extensive network of sales offices, representatives, and distributors across the country to help customers meet the most demanding market conditions. To assist with installation, commissioning and ongoing services.

Schneider Electric Infrastructure Company Overview

| Company Name | Schneider Electric Infrastructure Ltd. |

| Founded | 2011 |

| Headquarters | Mumbai |

| Industry | Manufacturing, Designing & Servicing |

| CEO | Udai SIngh |

| Stock Exchange Listing | NSE & BSE |

| Official Website | infra.schneider-electric.co.in |

Schneider Electric Infrastructure Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹17,027.79 Cr. |

| ROE | 81.83% |

| ROCE | 38.69% |

| P/E | 86.44 |

| P/B | 42.62 |

| Div. Yield | 0% |

| Book Value | ₹16.71 |

| Face Value | ₹2 |

| EPS (TTM) | ₹8.24 |

| 52 Week High | ₹980 |

| 52 Week Low | ₹435.35 |

Also Read: Tech Mahindra Share Price Target

Schneider Electric Infrastructure Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 22.07B | 24.17% |

| Operating Expense | 5.15B | 28.31% |

| Net Income | 1.72B | 39.15% |

| Net Profit Margin | 7.80 | 12.07% |

| Earnings Per Share | — | — |

| EBITDA | 2.94B | 74.38% |

| Effective Tax Rate | 18.08% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 473.00M | 141.82% |

| Total Assets | 15.82B | 16.63% |

| Total Liabilities | 12.85B | 6.67% |

| Total Equity | 2.96B | — |

| Shares Outstanding | 239.10M | — |

| Price to Book | 80.47 | — |

| Return on Assets | 11.73% | — |

| Return on Capital | 22.54% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 1.72B | 39.15% |

| Cash from Operations | 1.92B | 119.09% |

| Cash from Investing | -569.50M | -51.58% |

| Cash from Financing | -1.07B | -68.18% |

| Net Change in Cash | 277.40M | 267.61% |

| Free Cash Flow | 413.63M | 147.49% |

Also Read: PNB Housing Finance Share Price Target

Schneider Electric Share Price – Target 2025 to 2030

| Year | Target Price |

|---|---|

| Schneider Electric Share Price Target 2025 | ₹933 |

| Schneider Electric Share Price Target 2026 | ₹1070 |

| Schneider Electric Share Price Target 2027 | ₹1184 |

| Schneider Electric Share Price Target 2028 | ₹1227 |

| Schneider Electric Share Price Target 2029 | ₹1372 |

| Schneider Electric Share Price Target 2030 | ₹1449 |

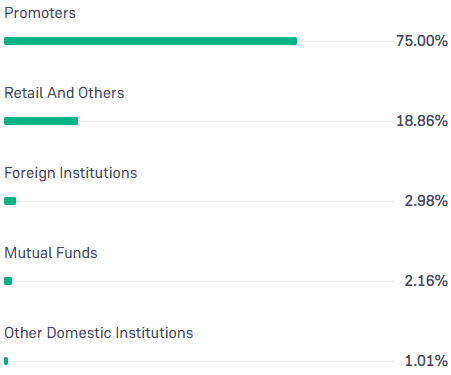

Schneider Electric Infrastructure Shareholding Pattern

- Retail & Other: 18.86%

- Promoters: 75.00%

- Foreign Institutions: 2.98%

- Mutual Funds: 2.16%

- Other Domestic Institutions: 1.01%

Also Read: IndiaMART Share Price Target

Schneider Electric Competitors/Peer Companies

- Siemens

- ABB India

- CG Power & Industrial Solutions (CG Power & Inds)

- Havells India Limited

- Bharat Heavy Electricals Limited (BHEL)

- Waaree Energies

- GE Vernova

- Thermax Limited

- Apar Industries Limited

- Crompton Greaves

Also Read: Hindalco Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.