Siemens Share Price: Whenever it comes to investing in the stock market, the name of Siemens company is on the lips of many people. Due to its excellent innovation and global presence, it has made its mark in the industrial and technology sector. But how much can the stock of this company be worth in the future?

If you are curious to know this, then through this article we will share with you information about Siemens stock price target from 2024 to 2030 and give many details keeping in mind the fundamentals and financial performance of the company.

Siemens Company Overview

Siemens Limited was established in the year 1867. It is a giant in the global technology sector due to its automation, innovation and digitalization. With its cutting-edge solutions and strong focus on sustainability, the company is also expanding its presence in some new sectors such as energy, health care, infrastructure and mobility.

The company’s strong diverse portfolio proves to be a great opportunity for all long-term investors within the industrial sector. Therefore, it is very important for you to understand the level to which the company can grow in the future.

| Company Name | Siemens Ltd. |

| Founded | 1867 |

| Headquarters | Munich, Germany |

| Industry | Technology |

| CEO | Sunil Mathur |

| Stock Exchange Listing | NSE & BSE |

| Official Website | siemens.com |

Siemens Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹2,61,694.97 Cr. |

| ROE | 15.53% |

| ROCE | 21.14% |

| P/E | 107.94 |

| P/B | 18.12 |

| Div. Yield | 0.14% |

| Book Value | ₹405.45 |

| Face Value | ₹2 |

| EPS (TTM) | ₹68.08 |

| 52 Week High | ₹8,129.90 |

| 52 Week Low | ₹3,575.55 |

Also Read: Adani Ports Share Price Target

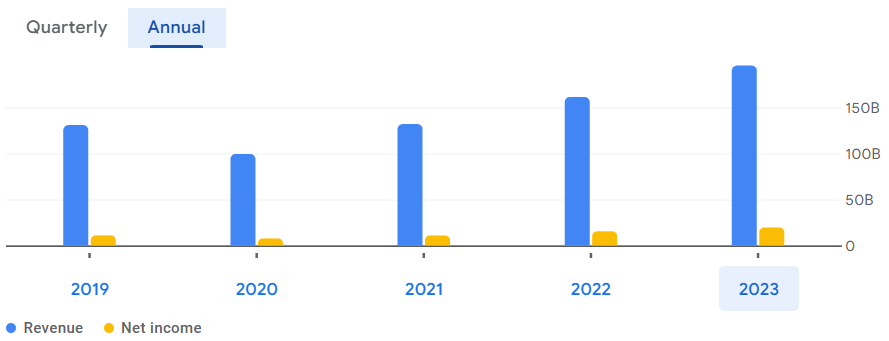

Siemens Financials

Income Statement

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 195.54B | 21.17% |

| Operating expense | 38.62B | 11.88% |

| Net income | 19.61B | 27.09% |

| Net profit margin | 10.03 | 4.92% |

| Earnings per share | 55.09 | 55.45% |

| EBITDA | 23.89B | 26.60% |

| Effective tax rate | 25.68% | — |

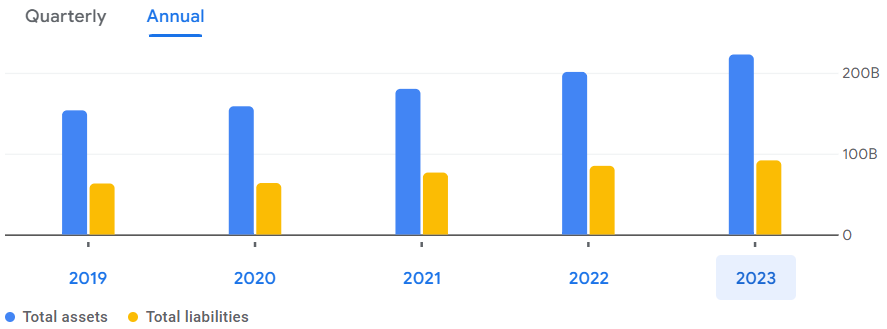

Balance Sheet

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Cash and short-term investments | 76.94B | 15.83% |

| Total assets | 222.65B | 10.72% |

| Total liabilities | 91.69B | 7.99% |

| Total equity | 130.96B | — |

| Shares outstanding | 356.12M | — |

| Price to book | 18.64 | — |

| Return on assets | 6.33% | — |

| Return on Capital | 10.70% | — |

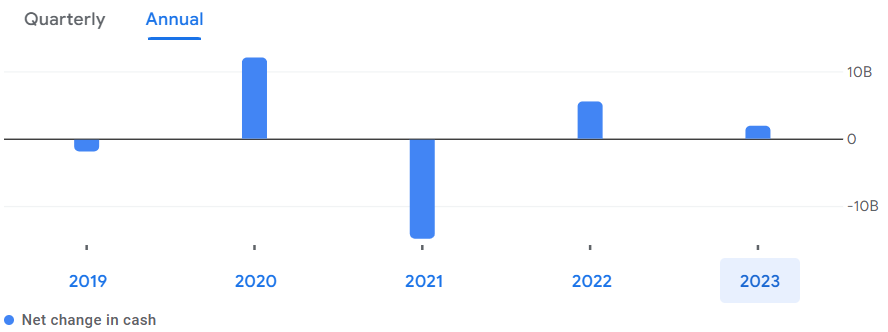

Cash Flow

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Net income | 19.61B | 27.09% |

| Cash from operations | 14.00B | 43.08% |

| Cash from investing | -7.59B | -2,049.58% |

| Cash from financing | -4.50B | -14.71% |

| Net change in cash | 1.91B | -65.39% |

| Free cash flow | 8.17B | -48.57% |

Also Read: IGL Share Price Target

Siemens Share Price Target From 2024 to 2030

| Year | Target Price |

|---|---|

| Siemens Share Price Target 2024 | ₹7850 |

| Siemens Share Price Target 2025 | ₹8890 |

| Siemens Share Price Target 2026 | ₹10050 |

| Siemens Share Price Target 2027 | ₹12780 |

| Siemens Share Price Target 2028 | ₹14150 |

| Siemens Share Price Target 2029 | ₹15850 |

| Siemens Share Price Target 2030 | ₹17570 |

Siemens Shareholding Pattern

- Retail & Other: 9.41%

- Promoters: 75.00%

- Foreign Institution: 8.69%

- Mutual Funds: 3.41%

- Other Domestic Institutions: 3.50%

Also Read: Adani Enterprises Share Price Target

Siemens Competitors/Peer Companies

- ABB India

- CG Power & Inds

- Havells India

- Waaree Energies

- GE Vernova T&D India

- Apar Industries

- BHEL

- Crompton Greaves

- Schneider Electric

- V Guard Industries

Conclusion

So in this article, we have understood where the Siemens share price predictions can reach from 2024 to 2030, while the company’s financial metrics and shareholding pattern reflect the company’s growth, now as the company continues to focus on digitization and automation, its fundamentals are becoming even stronger, which can be a good choice for long-term investors, but short-term investors should think once before investing in a stock with such a high valuation.

If you have any query or additional information related to this company, make sure to share it in the comment section below, we will definitely add that information in the post if it is right.

To connect with us, click on the given Facebook or WhatsApp button.

FAQs

-

Is SIEMENS a good stock to buy?

Yes, it is a good stock to buy.

-

Is SIEMENS good for long term?

Yes, it is good for long-term.

-

Is Siemens India overvalued?

Yes, it is overvalued.

-

Is Siemens a profitable company?

Yes, it is a profitable company.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company.