Vikas EcoTech Share Price Target 2025: Vikas Ecotech Ltd., a dynamic player in the specialty chemicals and plastics industry, is known for its commitment to eco-friendly products.

With a market cap of ₹520 crore, this small-scale company focuses on lead-free additives and reinforcing compounds used in various sectors including agriculture, infrastructure, healthcare, and consumer electronics.

In recent years, Vikas Ecotech has made significant progress in promoting sustainable solutions, making it an attractive prospect for investors eyeing long-term growth from 2025 to 2030.

Vikas EcoTech Company Overview

| Company Name | Vikas Ecotech Ltd. |

| Founded | 1984 |

| Headquarters | New Delhi |

| Industry | Chemicals Manufacturing |

| Chairman | Ravi Kumar Gupta |

| Stock Exchange Listing | NSE & BSE |

| Official Website | vikasecotech |

Vikas EcoTech Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹520 Cr. |

| ROE | 2.15% |

| ROCE | 4.63% |

| P/E | 32.92 |

| P/B | 0.95 |

| Div. Yield | 0% |

| Book Value | ₹3.10 |

| Face Value | ₹1 |

| EPS (TTM) | ₹0.09 |

| 52 Week High | ₹5.63 |

| 52 Week Low | ₹2.91 |

Also Read: Persistent Systems Share Price Target

Vikas EcoTech Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 2.59B | -35.77% |

| Operating Expense | 175.11M | -9.85% |

| Net Income | 68.47M | -28.14% |

| Net Profit Margin | 2.65 | 11.81% |

| Earnings Per Share | — | — |

| EBITDA | 170.08M | -24.47% |

| Effective Tax Rate | 27.34% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 13.74M | 561.53% |

| Total Assets | 4.44B | 29.48% |

| Total Liabilities | 671.59M | -35.83% |

| Total Equity | 3.76B | — |

| Shares Outstanding | 1.39B | — |

| Price to Book | 1.11 | — |

| Return on Assets | 2.10% | — |

| Return on Capital | 2.38% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 68.47M | -28.14% |

| Cash from Operations | 1.20B | 31.14% |

| Cash from Investing | -2.03B | -249.28% |

| Cash from Financing | 826.03M | 302.48% |

| Net Change in Cash | 2.42M | 103.28% |

| Free Cash Flow | 1.20B | 73.39% |

Also Read: Zensar Technologies Share Price Target

Vikas EcoTech Share Price Target 2025

| Years | Months | Target Price |

|---|---|---|

| Vikas EcoTech Share Price Target 2025 | January | ₹3.23 |

| Vikas EcoTech Share Price Target 2025 | February | ₹3.90 |

| Vikas EcoTech Share Price Target 2025 | March | ₹4.37 |

| Vikas EcoTech Share Price Target 2025 | April | ₹4.96 |

| Vikas EcoTech Share Price Target 2025 | May | ₹5.36 |

| Vikas EcoTech Share Price Target 2025 | June | ₹5.89 |

| Vikas EcoTech Share Price Target 2025 | July | ₹6.10 |

| Vikas EcoTech Share Price Target 2025 | August | ₹6.41 |

| Vikas EcoTech Share Price Target 2025 | September | ₹6.99 |

| Vikas EcoTech Share Price Target 2025 | October | ₹7.47 |

| Vikas EcoTech Share Price Target 2025 | November | ₹8.00 |

| Vikas EcoTech Share Price Target 2025 | December | ₹8.53 |

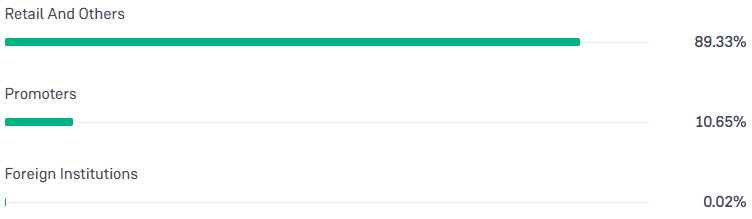

Vikas EcoTech Shareholding Pattern

- Retail & Other: 89.33%

- Promoters: 10.65%

- Foreign Institutions: 0.02%

- Mutual Funds: 0.00%

- Other Domestic Institutions: 0.00%

Also Read: Pidilite Industries Share Price Target

Vikas EcoTech Competitors/Peer Companies

- Swan Energy

- Andrew Yule & Company

- TTK Healthcare

- BCL Industries

- Krishna Defence

- Empire Industries

- Tara Chand Infralogistics

- Spectrum Talent Management

- Gillanders Arbuthnot & Company

- Sobhagya Mercantile Limited

Also Read: Cyient Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.