Azad Engineering Share Price: Azad Engineering Limited is a very big company working in the engineering and manufacturing sector of India. This company has attracted the attention of investors due to its good performance and growth. Here we will discuss about the Azad Engineering Share Price Future Prediction from 2024 to 2030.

Azad Engineering Ltd. Company Overview

Azad Engineering works in different sectors like automotive, aerospace, and industrial machinery and is known for its high-quality products and new innovations.

Knowing the stock price of this company is very important for your investment. Therefore, in this blog, we will give complete information about many important things along with Azad Engineering Share Price Target.

| Company Name | Azad Engineering Ltd. |

| Founded | 1983 |

| Headquarters | Hyderabad, Telangana |

| Industry | Aerospace, Defense, Energy, and Oil and Gas |

| CEO | Rakesh Chopdar |

| Stock Exchange Listing | NSE & BSE |

| Official Website | azad.in |

Azad Engineering Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹2,61,694.97 Cr. |

| ROE | 15.53% |

| ROCE | 21.14% |

| P/E | 107.94 |

| P/B | 18.12 |

| Div. Yield | 0.14% |

| Book Value | ₹405.45 |

| Face Value | ₹2 |

| EPS (TTM) | ₹68.08 |

| 52 Week High | ₹8,129.90 |

| 52 Week Low | ₹3,575.55 |

Also Read: Suzlon Share Price Target

Azad Engineering Financials

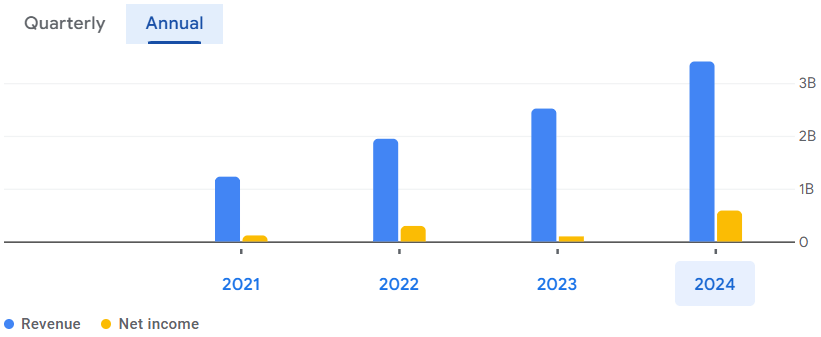

Income Statement

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 3.41B | 35.40% |

| Operating expense | 1.96B | 22.18% |

| Net income | 585.80M | 591.37% |

| Net profit margin | 17.19 | 410.09% |

| Earnings per share | 11.20 | — |

| EBITDA | 1.17B | 54.51% |

| Effective tax rate | 27.49% | — |

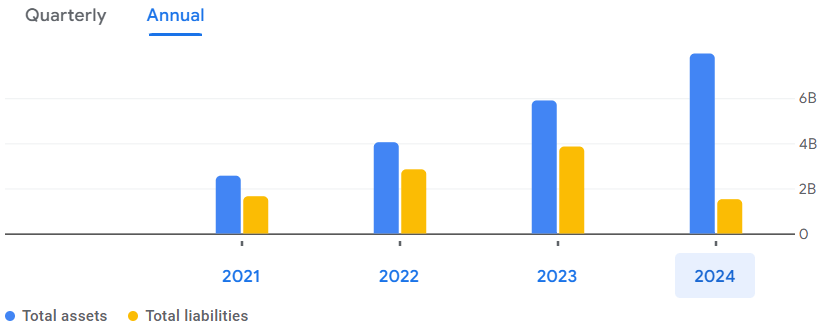

Balance Sheet

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Cash and short-term investments | 587.62M | 46.55% |

| Total assets | 7.97B | 35.28% |

| Total liabilities | 1.52B | -60.54% |

| Total equity | 6.45B | — |

| Shares outstanding | 59.11M | — |

| Price to book | 14.46 | — |

| Return on assets | 8.66% | — |

| Return on Capital | 10.10% | — |

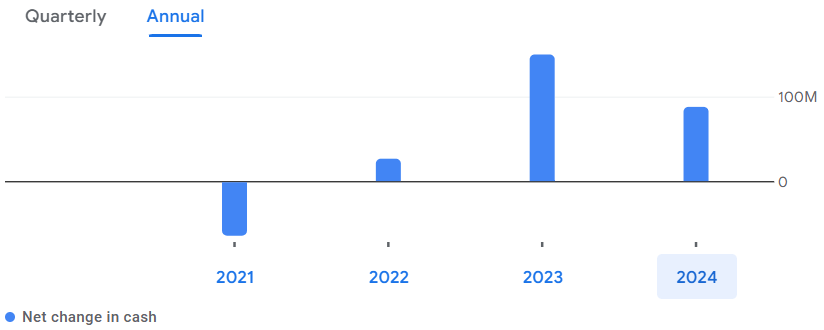

Cash Flow

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Net income | 585.80M | 591.37% |

| Cash from operations | -69.49M | 31.93% |

| Cash from investing | -552.55M | 45.37% |

| Cash from financing | 709.87M | -43.81% |

| Net change in cash | 87.83M | -41.37% |

| Free cash flow | -1.15B | 23.25% |

Also Read: Growth Plans vs IDCW in Mutual Fund [Which is BEST]

Azad Engineering Share Price Target From 2024 to 2030

| Year | Target Price |

|---|---|

| Azad Engineering Share Price Target 2024 | ₹2000 |

| Azad Engineering Share Price Target 2025 | ₹3010 |

| Azad Engineering Share Price Target 2026 | ₹4000 |

| Azad Engineering Share Price Target 2027 | ₹4900 |

| Azad Engineering Share Price Target 2028 | ₹5880 |

| Azad Engineering Share Price Target 2029 | ₹6910 |

| Azad Engineering Share Price Target 2030 | ₹7950 |

Factors Affecting Azad Engineering’s Share Price

There are many factors affecting the share price of Azad Engineering and these factors can give information about the fluctuations of the stock.

1. Market Demand and Industry Trends

The demand for engineering solutions has a direct impact on the earnings and profits of Azad Engineering. If sectors such as automotive, aerospace or industrial machinery grow, new business opportunities are created for the company and its share price may also increase. Industry trends, new technology and market expansion also affect share prices.

2. Financial Performance

Investors pay attention to the financial performance of a company such as revenue, net income and earnings per share (EPS). Consistent growth in these figures indicates a healthy and profitable business, which can increase the share price.

Important financial ratios such as the price-to-earnings (P/E) ratio and return on equity (ROE) help in understanding the company’s valuation and investors’ returns.

3. Economic Conditions

Economic factors such as GDP growth, inflation rate and interest rates affect the company’s business. A growing economy usually increases the demand for engineering services, which leads to good performance of the company. However, an economic recession or other economic fluctuations can affect the company’s share prices.

4. Company Development

Announcements of new projects, partnerships or strategic programs can impact a company’s stock price. Positive news such as new projects or expansion into new markets increases investor confidence and can drive the stock price up. Negative news or issues can drive the stock price down.

Also Read: Power Grid Share Price Target

Azad Engineering Shareholding Pattern

- Retail & Other: 18.61%

- Promoters: 65.90%

- Foreign Institution: 9.74%

- Mutual Funds: 5.47%

- Other Domestic Institutions: 0.27%

Azad Engineering Competitors/Peer Companies

- Praj Industries

- HAL

- Thermax

- Jupiter Wagons

- Texmaco Rail

- BEML

- Skipper

- Titagarh Railsystems

- Kabra Extrusion

- MTAR Technologies

Also Read: What is Fundamental Analysis in Share Market?

Market Position & Challenges

Azad Engineering’s stock has reflected the company’s success and good strategies. In the last few years, the company has seen good growth, which is due to its strong business model and market expansion. Let’s know some important points about the financial condition of the company:

- Revenue Growth: Azad Engineering’s revenue growth is very good due to its different products and market expansion.

- Profitability: The company’s profit has been good which shows its effective cost management and operational efficiency.

- Stock Performance: The positive performance of Azad Engineering’s stocks attracts the attention of large and small investors.

How To Analyse Azad Engineering Stock Price Targets?

When analysing Azad Engineering stock price target, follow these tips to make a decision:

1. Understand financial reports

Look at the company’s quarterly and annual reports. Look at data such as revenue growth, profit and financial ratios to get an idea of the company’s performance and stability. Also pay attention to changes in debt levels, cash flow and capital expenditures.

2. Keep an eye on market trends

Be aware of market trends and industrial developments that may impact Azad Engineering. Economic indicators, changes in technology and changes in regulations may impact the company’s business and share price.

3. Expert opinion

Pay attention to the advice of financial analysts and experts who prepare reports on Azad Engineering. Their views and projections can give you insight into share price movement. Keep their reports and target ranges in mind.

4. Company Development

Stay updated on Azad Engineering’s new projects, partnerships, and strategies. These announcements can boost the company’s growth and also push the stock price up.

Also Read: Jubilant Food Share Price Target

Azad Engineering Share Price Targets Analysis

Analysts and financial experts determine a company’s share price targets based on the company’s financial position, market conditions and growth prospects. These analyses are useful for investors.

Short-term Price Targets

In the short-term, analysts look at the company’s recent financial performance, quarterly results and market developments. Azad Engineering targets are often based on current market conditions and recent news. Analysts may change these targets based on quarterly profit reports and new updates from the company.

Long-term Price Targets

In the long-term, analysts look at the company’s growth prospects, strategic initiatives and industry trends. They often predict stable growth in share prices based on the company’s strong fundamentals and good market conditions. Long-term analyses are based on the company’s growth, risk management and taking advantage of new opportunities.

Conclusion

Azad Engineering Ltd offers a good investment opportunity in the engineering sector. Its strong financial performance, market expansion and industry position are positive for its share price.

By examining financial data, paying attention to market trends and understanding expert advice, investors can make the right decision about Azad Engineering Share Price Target.

For any investment, it is important that you do thorough research and consult a financial advisor so that your investment plan matches your financial goals and risk.

To connect with us, click on the given Facebook or WhatsApp button.

FAQs

-

Is Azad Engineering a good stock?

Yes.

-

Is Azad Engineering good for long term?

Yes.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company.

Pingback: IDFC First Bank Share Price: Target 2024 to 2030

Pingback: Samvardhana Motherson Share Price: Target 2024 to 2030