If you invest in the stock market, you must know the HCC share price targets for 2025, 2026, 2027, 2028, 2029, and 2030. Here, you will get detailed information regarding all your queries, such as its fundamentals, shareholdings, financial performance, future predictions, and more.

Hindustan Construction Company (HCC) Company Overview

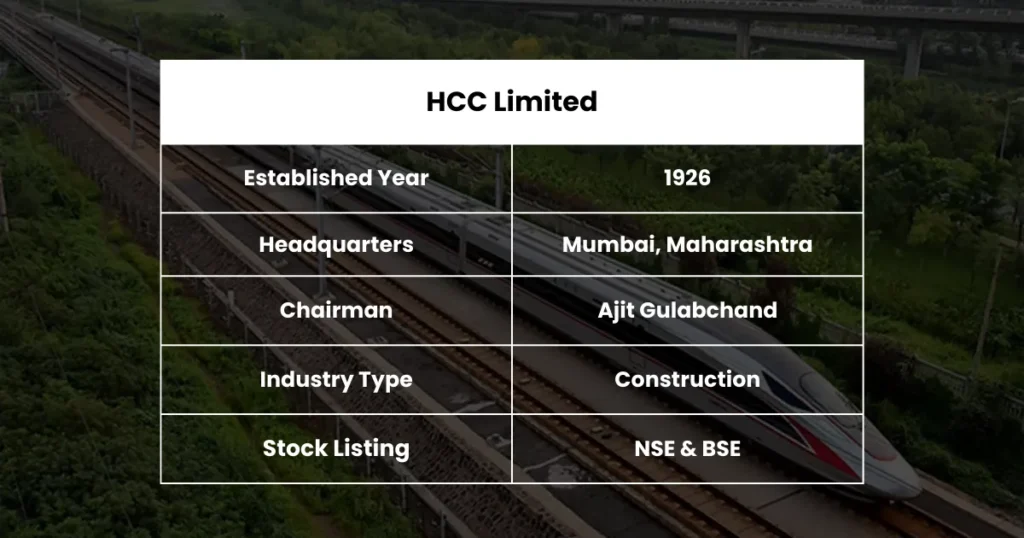

Hindustan Construction Company Limited (HCC), founded in 1926, is a leading infrastructure development company headquartered in Mumbai, Maharashtra. With nearly a century of expertise, HCC has played a key role in shaping India’s infrastructure landscape by executing large-scale projects in transportation, power, water, and urban development. The company specializes in the construction of dams, tunnels, highways, bridges, metro systems, and nuclear power plants.

HCC has been at the forefront of engineering excellence, having completed some of India’s most challenging projects, including the Bandra-Worli Sea Link, the Kolkata Metro, and several hydropower projects in the Himalayas. The company is known for its commitment to innovation, sustainability, and safety standards.

It is publicly listed on the NSE and BSE, reflecting its strong market presence and long-term growth vision.

Fundamentals of Hindustan Construction Company (HCC)

- Market Cap: ₹5,008.76 Cr.

- ROE: 21.75%

- ROCE: 34.22%

- P/E Ratio: 0

- P/B Ratio: 2.91

- Dividend Yield: 0%

- Book Value: ₹9.46

- Face Value: ₹1

- EPS (TTM): ₹-0.58

- 52-Week High: ₹57.50

- 52-Week Low: ₹21.97

Also Read: Devyani International Share Price

HCC Share Price Target 2025

After analyzing HCC’s past price trends and market performance, it is estimated that the stock could reach ₹1,380.28 by early 2025.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹1,540.21.

By the end of 2025, HCC’s share price can achieve the target of ₹1,650.00.

| Month | Target Price (₹) |

|---|---|

| January | ₹32.05 |

| February | ₹23.61 |

| March | ₹25.14 |

| April | ₹26.78 |

| May | ₹28.42 |

| June | ₹29.85 |

| July | ₹30.72 |

| August | ₹31.48 |

| September | ₹32.05 |

| October | ₹32.84 |

| November | ₹33.52 |

| December | ₹34.20 |

HCC Share Price Target 2026

After analyzing HCC’s past price trends and market performance, it is estimated that the stock could reach ₹1,680.48 by early 2026.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹1,850.74.

By the end of 2026, HCC’s share price can achieve the target of ₹2,050.32.

| Year | Target Price (₹) |

|---|---|

| Beginning | ₹34.80 |

| Middle | ₹38.45 |

| End | ₹42.10 |

HCC Share Price Target 2027

After analyzing HCC’s past price trends and market performance, it is estimated that the stock could reach ₹2,100.56 by early 2027.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹2,250.42.

By the end of 2027, HCC’s share price can achieve the target of ₹2,400.38.

| Year | Target Price (₹) |

|---|---|

| Beginning | ₹44.15 |

| Middle | ₹47.60 |

| End | ₹52.30 |

Also Read: Protean Share Price

HCC Share Price Target 2028

After analyzing HCC’s past price trends and market performance, it is estimated that the stock could reach ₹2,430.64 by early 2028.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹2,580.35.

By the end of 2028, HCC’s share price can achieve the target of ₹2,750.48.

| Year | Target Price (₹) |

|---|---|

| Beginning | ₹55.20 |

| Middle | ₹60.48 |

| End | ₹66.05 |

HCC Share Price Target 2029

After analyzing HCC’s past price trends and market performance, it is estimated that the stock could reach ₹2,780.62 by early 2029.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹2,950.38.

By the end of 2029, HCC’s share price can achieve the target of ₹3,150.72.

| Year | Target Price (₹) |

|---|---|

| Beginning | ₹69.75 |

| Middle | ₹75.62 |

| End | ₹82.30 |

HCC Share Price Target 2030

After analyzing HCC’s past price trends and market performance, it is estimated that the stock could reach ₹3,180.46 by early 2030.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹3,350.64.

By the end of 2030, HCC’s share price can achieve the target of ₹3,500.89.

| Year | Target Price (₹) |

|---|---|

| Beginning | ₹86.48 |

| Middle | ₹92.75 |

| End | ₹100.30 |

Also Read: Avanti Feeds Share Price

HCC Share Price Target & Forecast 2025 To 2030

| Year | Target Price |

|---|---|

| 2025 | ₹34.20 |

| 2026 | ₹42.10 |

| 2027 | ₹52.30 |

| 2028 | ₹66.05 |

| 2029 | ₹82.30 |

| 2030 | ₹100.30 |

Shareholding Pattern of Hindustan Construction Company (HCC)

- Retail & Other: 62.43%

- Promoters: 16.72%

- Foreign Institution: 13.35%

- Mutual Funds: 1.02%

- Other Domestic Institutions: 6.49%

Also Read: IRCON Share Price

Hindustan Construction Company (HCC) Income Statement

HCC reported a 14.99% decline in revenue to ₹70.31 billion. Despite the decline in revenue, operating expenses decreased by 10.20%, reflecting cost control efforts. Net income increased 1,817.53% to ₹4.78 billion, mainly due to one-time benefits or significant cost reductions.

Net profit margin increased significantly to 6.80% (an increase of 2,100%), indicating strong bottom-line growth despite lower revenue. EBITDA increased 31.49% to ₹6.64 billion, reflecting improved profitability at the operating level. The effective tax rate stood at 31.92%, reflecting higher tax incidence.

Hindustan Construction Company (HCC) Balance Sheet

HCC’s total assets declined by 31.25% to ₹90.59 billion, while total liabilities also declined by 33.58% to ₹92.28 billion. However, total equity remains negative at -₹1.68 billion, indicating a highly leveraged position. Cash and short-term investments declined significantly by 55.53% to ₹5.13 billion, raising liquidity concerns.

The price-to-book (P/B) ratio is negative at -22.14, indicating weak fundamentals in terms of asset valuation. Return on assets (ROA) improved to 3.32%, while return on capital (ROC) stood at 10.77%, indicating better efficiency in capital utilization despite financial volatility.

Hindustan Construction Company (HCC) Cash Flow

HCC generated ₹906.80 million (a growth of 466.75%) from operations, reflecting improved cash generation despite its higher debt. Cash from investments was positive at ₹8.25 billion, higher by 93.80%, possibly due to asset sales.

Cash from financing was negative at -₹8.10 billion, reflecting debt repayment or lower borrowings. Net change in cash remained negative at -₹1.83 billion, reflecting cash outflows. Free cash flow remained negative at -₹9.54 billion, reflecting continued financial stress.

Also Read: GRSE Share Price

Key Competitors of Hindustan Construction Company (HCC)

- Rail Vikas Nigam

- Afcons Infrastructure

- IRB Infrastructure Developers

- Ircon International

- GR Infraprojects

- PNC Infratech

- NCC (formerly Nagarjuna Construction Company)

- ITD Cementation India

- Dilip Buildcon

- H.G. Infra Engineering

HCC Share Price FAQ

Is HCC a good company?

Yes, HCC is a good company.

What is the share price of HCC in 2025?

The share price of HCC in 2025 is ₹34.20

What is the share price of HCC in 2030?

The share price of HCC in 2030 is ₹100.30

Is HCC a debt-free company?

No, HCC is not a debt-free company.

Is HCC overvalued or undervalued?

HCC is undervalued.

Also Read: KEI Industries Share Price

Disclaimer: The information in this article is for educational purposes only, and market analysts give the targets mentioned in it as suggestions. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

We have more than 5 years of experience in stock market and analysis, and we are dedicated to delivering accurate, real-time market updates and insightful analysis. With a sharp eye on the Indian and global stock markets, we simplify complex financial data and trends to help investors make informed decisions.

Disclaimer: The stock market updates shared by DateUpdateGo are solely for general information and learning purpose only. They are not meant to serve as an investment advice. Individuals should always seek guidance from a certified financial advisor before making any investment-related choices.