Hindalco Share Price: Hindalco Industries Limited (Hindalco), which operates in the aluminium industry, is part of the Basic Materials sector. In this detailed post, we will explore Hindalco’s stock price targets for 2025, 2026 and 2030.

Using various technical analysis approaches and machine learning models trained on past performance, we will forecast these targets. Known for its significant presence in the Indian stock market, Hindalco Industries Limited has shown various trends over the years.

We will discuss Hindalco’s current market position, its growth path and how its price performance may be affected by external market factors until 2030.

Hindalco Industries Company Overview

| Company Name | Hindalco Industries Ltd. |

| Founded | 1958 |

| Headquarters | Mumbai |

| Industry | Metals |

| Chairman | Kumar Mangalam Birla |

| Stock Exchange Listing | NSE & BSE |

| Official Website | hindalco.com |

Hindalco Industries Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹1,37,833.64 Cr. |

| ROE | 6.03% |

| ROCE | 8.23% |

| P/E | 24.56 |

| P/B | 2.02 |

| Div. Yield | 0.57% |

| Book Value | ₹303.02 |

| Face Value | ₹1 |

| EPS (TTM) | ₹24.97 |

| 52 Week High | ₹772 |

| 52 Week Low | ₹496.80 |

Also Read: Premier Energies Share Price Target

Hindalco Industries Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 2.16T | -3.24% |

| Operating Expense | 505.10B | 3.46% |

| Net Income | 101.55B | 0.57% |

| Net Profit Margin | 4.70 | 3.98% |

| Earnings Per Share | 45.58 | 0.53% |

| EBITDA | 241.90B | 5.20% |

| Effective Tax Rate | 27.53% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 181.41B | -14.96% |

| Total Assets | 2.32T | 3.15% |

| Total Liabilities | 1.26T | -3.27% |

| Total Equity | 1.06T | — |

| Shares Outstanding | 2.22B | — |

| Price to Book | 1.29 | — |

| Return on Assets | 4.69% | — |

| Return on Capital | 6.53% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 101.55B | 0.57% |

| Cash from Operations | 240.56B | 25.24% |

| Cash from Investing | -142.76B | -78.09% |

| Cash from Financing | -108.17B | -3.51% |

| Net Change in Cash | -10.28B | -185.74% |

| Free Cash Flow | 42.58B | 235.82% |

Also Read: Tech Mahindra Share Price Target

Hindalco Share Price Target From 2025 to 2030

| Year | Target Price |

|---|---|

| Hindalco Share Price Target 2025 | ₹824.58 |

| Hindalco Share Price Target 2026 | ₹1,077.23 |

| Hindalco Share Price Target 2027 | ₹1,445.75 |

| Hindalco Share Price Target 2028 | ₹1,993.20 |

| Hindalco Share Price Target 2029 | ₹2,468.24 |

| Hindalco Share Price Target 2030 | ₹3,138.72 |

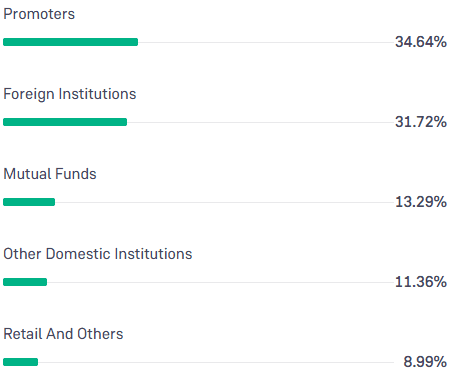

Hindalco Industries Shareholding Pattern

- Retail & Other: 8.99%

- Promoters: 34.64%

- Foreign Institutions: 31.72%

- Mutual Funds: 13.29%

- Other Domestic Institutions: 11.36%

Also Read: PNB Housing Finance Share Price Target

Hindalco Industries Competitors/Peer Companies

- NALCO

- GSM Foils

- Nirav Commercials

- Synthiko Foils

Also Read: IndiaMART Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

I am a seasoned stock market expert who specializes in analyzing India’s economic indicators and their impact on listed companies. My market forecasts are based on macroeconomic insights, corporate earnings, and sector performance. I am known for offering practical and reliable predictions for retail and institutional investors alike.