If you invest in the stock market, you must know the Infosys share price targets for 2025, 2026, 2027, 2028, 2029, and 2030. Here, you will get detailed information regarding all your queries, such as its fundamentals, shareholdings, financial performance, future predictions, and more.

Infosys Company Overview

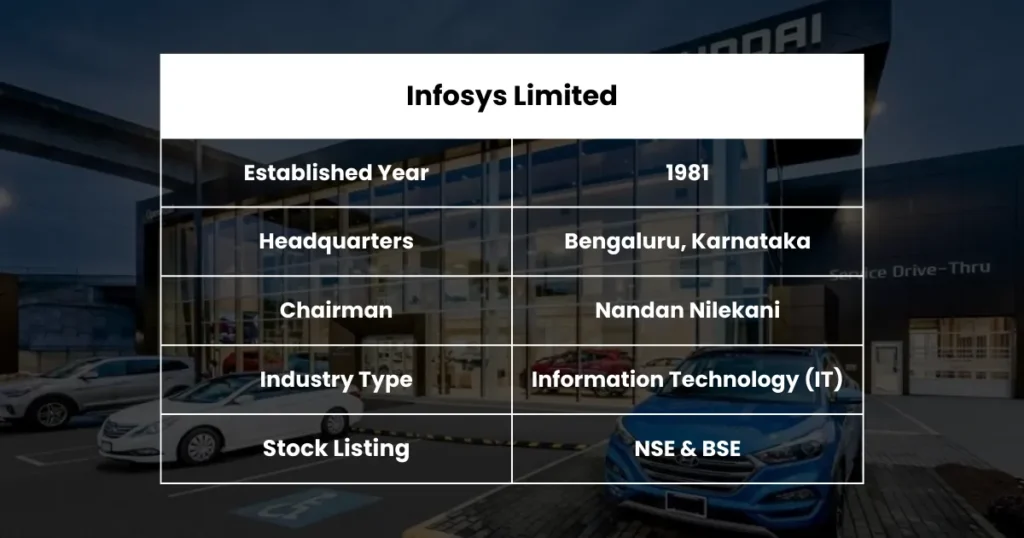

Infosys Limited, founded in 1981, is a global leader in information technology services and consulting, headquartered in Bengaluru, Karnataka. Founded by a group of visionary entrepreneurs, Infosys has become one of India’s best-known IT companies, serving clients in over 50 countries.

The company specializes in services, including software development, cloud computing, artificial intelligence (AI), digital transformation, data analytics, and business process outsourcing (BPO). Infosys has earned a strong reputation for its emphasis on innovation, sustainability, and customer-centric solutions.

Under the leadership of Chairman Nandan Nilekani, Infosys has maintained its focus on providing cutting-edge technology solutions while upholding the values of transparency and corporate governance. Listed on both the NSE and BSE, Infosys drives digital transformation for enterprises around the world, contributing significantly to India’s IT success story.

Fundamentals of Infosys

- Market Cap: ₹6,54,595.42 Cr.

- ROE: 37.02%

- ROCE: 48.66%

- P/E Ratio: 23.87

- P/B Ratio: 7.35

- Dividend Yield: 2.87%

- Book Value: ₹214.58

- Face Value: ₹5

- EPS (TTM): ₹66.03

- 52-Week High: ₹2,006.80

- 52-Week Low: ₹1,359.10

Also Read: Rural Electrification Corporation – REC Share Price Target

Infosys Share Price Target 2025

After analyzing Infosys’s past price trends and market performance, it is estimated that the stock could reach ₹1,750.42 by early 2025.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹1,880.92.

By the end of 2025, Infosys’s share price can achieve the target of ₹1,960.00.

| Month | Target Price |

|---|---|

| January | ₹1,879.80 |

| February | ₹1,687.70 |

| March | ₹1,720.65 |

| April | ₹1,750.42 |

| May | ₹1,785.19 |

| June | ₹1,820.68 |

| July | ₹1,860.34 |

| August | ₹1,880.92 |

| September | ₹1,900.45 |

| October | ₹1,920.78 |

| November | ₹1,945.39 |

| December | ₹1,960.00 |

Infosys Share Price Target 2026

After analyzing Infosys’s past price trends and market performance, it is estimated that the stock could reach ₹1,980.52 by early 2026.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹2,300.68.

By the end of 2026, Infosys’s share price can achieve the target of ₹2,500.27.

| Year 2026 | Target Price |

|---|---|

| Beginning | ₹1,980.52 |

| Middle | ₹2,300.68 |

| End | ₹2,500.27 |

Infosys Share Price Target 2027

After analyzing Infosys’s past price trends and market performance, it is estimated that the stock could reach ₹2,520.14 by early 2027.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹2,800.59.

By the end of 2027, Infosys’s share price can achieve the target of ₹3,050.78.

| Year 2027 | Target Price |

|---|---|

| Beginning | ₹2,520.14 |

| Middle | ₹2,800.59 |

| End | ₹3,050.78 |

Also Read: Bajaj Auto Share Price Target

Infosys Share Price Target 2028

After analyzing Infosys’s past price trends and market performance, it is estimated that the stock could reach ₹3,070.83 by early 2028.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹3,400.26.

By the end of 2028, Infosys’s share price can achieve the target of ₹3,900.41.

| Year 2028 | Target Price |

|---|---|

| Beginning | ₹3,070.83 |

| Middle | ₹3,400.26 |

| End | ₹3,900.41 |

Infosys Share Price Target 2029

After analyzing Infosys’s past price trends and market performance, it is estimated that the stock could reach ₹3,950.28 by early 2029.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹4,280.62.

By the end of 2029, Infosys’s share price can achieve the target of ₹4,600.72.

| Year 2029 | Target Price |

|---|---|

| Beginning | ₹3,950.28 |

| Middle | ₹4,280.62 |

| End | ₹4,600.72 |

Infosys Share Price Target 2030

After analyzing Infosys’s past price trends and market performance, it is estimated that the stock could reach ₹4,620.38 by early 2030.

By the middle of the year, driven by market demand and sector performance, the price could rise to around ₹5,050.41.

By the end of 2030, Infosys’s share price can achieve the target of ₹5,400.58.

| Year 2030 | Target Price |

|---|---|

| Beginning | ₹4,620.38 |

| Middle | ₹5,050.41 |

| End | ₹5,400.58 |

Also Read: Subex Share Price Target

Infosys Share Price Target & Forecast 2025 To 2030

| Year | Target Price |

|---|---|

| 2025 | ₹1,960.00 |

| 2026 | ₹2,500.27 |

| 2027 | ₹3,050.78 |

| 2028 | ₹3,900.41 |

| 2029 | ₹4,600.72 |

| 2030 | ₹5,400.58 |

Shareholding Pattern of Infosys

- Retail & Other: 13.91%

- Promoters: 14.43%

- Foreign Institution: 33.30%

- Mutual Funds: 20.05%

- Other Domestic Institutions: 18.32%

Also Read: Triveni Turbine Share Price Target

Infosys Income Statement

Infosys recorded modest revenue growth of $18.56 billion (+1.92% YoY), reflecting stable demand for its IT services. Net income grew 6.24% to $3.17 billion, supported by cost control and margin improvement. Net profit margin expanded to 17.06% (+4.22%), reflecting improved profitability.

EBITDA remained stable at approximately $4.21 billion (+0.07%), reflecting stable operating performance. Earnings per share (EPS) increased 9.99% to $63.29, reflecting higher profitability per share. The effective tax rate stood at 27.08%, consistent with previous levels.

Infosys Balance Sheet

Infosys maintained a strong balance sheet with total assets growing 7.91% to $16.52 billion. Cash and short-term investments grew 43.02% to $3.32 billion, strengthening liquidity. Total liabilities decreased by 2.79% to $5.92 billion, improving financial stability. Total equity increased to $10.61 billion, reflecting retained earnings growth.

Return on assets (ROA) at 15.05% and return on capital (ROC) at 21.94% indicate strong capital efficiency. The price-to-book (P/B) ratio at 651.61 shows that the stock is trading at a premium, reflecting high market confidence.

Infosys Cash Flow

Cash from operations increased by 10.34% to $3.15 billion, supported by stable revenue and profit growth. Cash from investments was negative at -$708 million (a decline of 224.77%), indicating an increase in capital expenditure or investments.

Cash from financing showed a significant outflow of -$2.12 billion (+35.64%), likely caused by dividends or share buybacks. Net change in cash stood at $292 million (+135.44%), reflecting improved cash management. However, free cash flow declined by 37.77% to $1.44 billion, likely due to higher capital expenditures.

Also Read: Powergrid Infrastructure Investment Trust – PGINVIT Share Price Target

Key Competitors of Infosys

- TCS

- HCL Technologies

- Tech Mahindra

- Wipro

- LTIMindtree

- Mphasis

- Persistent Systems

- L&T Tech Services

Infosys Share Price Target FAQ

-

Is Infosys a good stock to buy for the long term?

Yes, Infosys is a good stock to buy for the long term.

-

What is the target price of Infosys in 2025?

The target price of Infosys in 2025 is ₹1,960.00

-

What is the target price of Infosys in 2030?

The target price of Infosys in 2030 is ₹5,400.58

-

Is Infosys overvalued or undervalued?

Infosys is overvalued.

-

Is Infosys worth buying now?

Yes, Infosys is worth buying now.

Also Read: Hyundai Motor India Share Price Target

Disclaimer: The information in this article is for educational purposes only, and market analysts give the targets mentioned in it as suggestions. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.