If you want to know the Coforge share price target from 2025 to 2030, this detailed analysis will tell you about its prospects, competitors, and the financial performance that can influence its share price in the coming years. Let’s find out if Coforge is a smart investment for your portfolio.

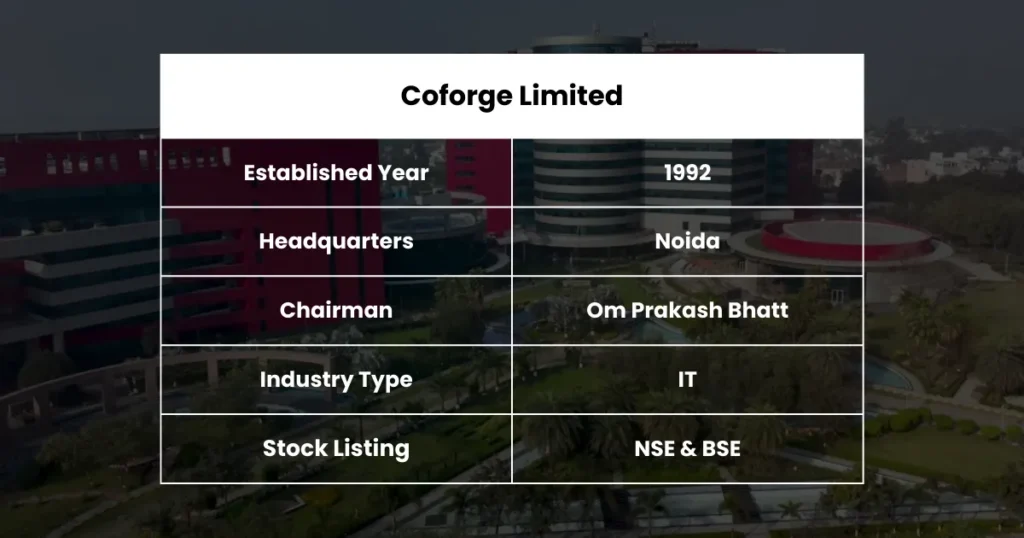

Coforge Company Overview

Coforge Limited, formerly known as NIIT Technologies, is a leading global IT services company headquartered in Noida, India. The company specializes in providing digital transformation services across industries such as banking, insurance, aviation, and others.

With a strong focus on innovation, Coforge leverages cutting-edge technologies such as AI, cloud computing, and blockchain to deliver tailored solutions to its clients.

Founded in 1992, Coforge has steadily expanded its global presence with delivery centers in key regions such as North America, Europe, and Asia-Pacific. Its commitment to operational excellence and customer satisfaction has helped the company build a strong reputation in the IT sector.

Stay tuned as we analyze Coforge’s financial trends, business strategy, and potential price targets for the coming years.

Coforge Fundamental Analysis

- Market Cap: ₹52,167.70 Cr.

- ROE: 34.22%

- ROCE: 34.55%

- P/E: 73.4

- P/B: 9.15

- Div. Yield: 0.96%

- Book Value: ₹852.64

- Face Value: ₹10

- EPS (TTM): ₹106.28

- 52 Week High: ₹10,026.80

- 52 Week Low: ₹4,287.25

Also Read: Tilak Ventures Share Price Target

Coforge Share Price Target 2025

After analyzing Bajaj Auto’s past price trends and market performance, it is estimated that the stock could reach ₹8,125.30 by early 2025.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹8,125.30.

By the end of 2025, Bajaj Auto’s share price can achieve the target of ₹9,782.00.

| Month | Target Price |

|---|---|

| January | ₹8,263.85 |

| February | ₹7,362.15 |

| March | ₹7,780.42 |

| April | ₹8,125.30 |

| May | ₹8,610.52 |

| June | ₹8,925.68 |

| July | ₹9,210.84 |

| August | ₹8,125.30 |

| September | ₹9,538.79 |

| October | ₹9,640.28 |

| November | ₹9,720.35 |

| December | ₹9,782.00 |

Coforge Share Price Target 2026

After analyzing Bajaj Auto’s past price trends and market performance, it is estimated that the stock could reach ₹9,850.64 by early 2026.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹10,360.27.

By the end of 2026, Bajaj Auto’s share price can achieve the target of ₹10,849.58.

| Year 2026 | Target Price |

|---|---|

| Beginning | ₹9,850.64 |

| Middle | ₹10,360.27 |

| End | ₹10,849.58 |

Coforge Share Price Target 2027

After analyzing Bajaj Auto’s past price trends and market performance, it is estimated that the stock could reach ₹10,950.48 by early 2027.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹11,380.79.

By the end of 2027, Bajaj Auto’s share price can achieve the target of ₹11,754.32.

| Year 2027 | Target Price |

|---|---|

| Beginning | ₹10,950.48 |

| Middle | ₹11,380.79 |

| End | ₹11,754.32 |

Also Read: PNB Share Price Target

Coforge Share Price Target 2028

After analyzing Bajaj Auto’s past price trends and market performance, it is estimated that the stock could reach ₹11,860.24 by early 2028.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹12,120.87.

By the end of 2028, Bajaj Auto’s share price can achieve the target of ₹12,387.69.

| Year 2028 | Target Price |

|---|---|

| Beginning | ₹11,860.24 |

| Middle | ₹12,120.87 |

| End | ₹12,387.69 |

Coforge Share Price Target 2029

After analyzing Bajaj Auto’s past price trends and market performance, it is estimated that the stock could reach ₹12,580.42 by early 2029.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹13,080.55.

By the end of 2029, Bajaj Auto’s share price can achieve the target of ₹13,682.94.

| Year 2029 | Target Price |

|---|---|

| Beginning | ₹12,580.42 |

| Middle | ₹13,080.55 |

| End | ₹13,682.94 |

Coforge Share Price Target 2030

After analyzing Bajaj Auto’s past price trends and market performance, it is estimated that the stock could reach ₹13,790.12 by early 2030.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹14,150.62.

By the end of 2030, Bajaj Auto’s share price can achieve the target of ₹14,517.37.

| Year 2030 | Target Price |

|---|---|

| Beginning | ₹13,790.12 |

| Middle | ₹14,150.62 |

| End | ₹14,517.37 |

Also Read: JK Tyre Share Price Target

Coforge Share Price Target & Forecast 2025 To 2030

| Year | Target Price |

|---|---|

| 2025 | ₹9,782 |

| 2026 | ₹10,849 |

| 2027 | ₹11,754 |

| 2028 | ₹12,387 |

| 2029 | ₹13,682 |

| 2030 | ₹14,517 |

Coforge Shareholding Pattern

- Retail & Other: 9.59%

- Promoters: NA

- Foreign Institution: 42.55%

- Mutual Funds: 35.80%

- Other Domestic Institutions: 12.06%

Also Read: Swiggy Share Price Target

Coforge Income Statement

Coforge reported a 14.53% YoY growth in revenue, reaching ₹91.79 billion, driven by strong demand for IT services and digital transformation solutions. Operating expenses increased by 21.45% to ₹24.63 billion, indicating higher costs related to talent acquisition and infrastructure expansion.

The company’s net income grew by 16.46% to ₹8.08 billion, leading to a net profit margin of 8.80%, reflecting a 1.62% improvement. Earnings per share (EPS) stood at ₹132.25, up 11.96% YoY, showcasing strong shareholder returns.

Coforge Balance Sheet

Coforge’s total assets grew by 7.47% to ₹61.08 billion, reflecting investments in business expansion and technology. Total liabilities decreased by 5.28% to ₹23.81 billion, suggesting improved debt management. Total equity stands at ₹37.27 billion, indicating a solid financial base.

The return on assets (ROA) is 11.91%, and the return on capital (ROC) is 17.16%, highlighting efficient capital utilization. The company’s price-to-book ratio is 14.00, indicating a premium valuation in the market.

Coforge Cash Flow Statement

Coforge’s net income of ₹8.08 billion contributed to cash from operations of ₹9.03 billion, reflecting a 4.96% decline, likely due to increased working capital requirements. Cash from investing was negative at -₹2.48 billion, suggesting capital expenditures for growth initiatives.

Cash from financing stood at -₹8.87 billion, down 58.90%, indicating higher dividend payouts or debt repayments. The net change in cash was negative at -₹2.49 billion, reflecting a 301.95% decline due to cash outflows in investment and financing activities. Free cash flow dropped by 78.23% to ₹2.35 billion, suggesting lower liquidity availability.

Also Read: Motilal Oswal Share Price Target

Coforge Key Competitors

- Tata Technologies

- OFSS

- PolicyBazaar

- Tata Elxsi

- KPIT Tech

- Affle India

- Cyient

- Zensar Technologies

- Newgen Software Technologies

- Birlasoft

Coforge Share Price Target FAQ

Is Coforge a good stock to buy?

Yes, it is a good stock to buy.

Is Coforge overvalued?

Yes, it is overvalued.

Is Coforge debt-free?

No, it is not debt-free.

Is Coforge a big company?

Yes, it is a big company.

Is Coforge good for the long term?

Yes, it is good for the long term.

Also Read: Adani Wilmar Share Price Target

Disclaimer: The information in this article is for educational purposes only, and market analysts give the targets mentioned in it as suggestions. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

We have more than 5 years of experience in stock market and analysis, and we are dedicated to delivering accurate, real-time market updates and insightful analysis. With a sharp eye on the Indian and global stock markets, we simplify complex financial data and trends to help investors make informed decisions.

Disclaimer: The stock market updates shared by DateUpdateGo are solely for general information and learning purpose only. They are not meant to serve as an investment advice. Individuals should always seek guidance from a certified financial advisor before making any investment-related choices.