Seacoast Shipping Share Price: Seacoast Shipping is a dominant player in the Maritime Industry today for its shipping services. According to experts, Seacoast Shipping Share Price Target From 2024 to 2030 are going to be very good in the coming times. So let us give you complete information about the company’s business along with its complete details.

Seacoast Shipping Services Limited Company Overview

This is a big shipping company in the maritime industry which provides shipping services by water ships all over the world. Their shipping network is very large, and they deliver their goods to other countries through their water ships at a very low cost. They provide their services in different industries such as Oil Gas and General Cargo Ship etc.

This company has expanded its network of International Maritime Route and has made a name for itself by making good partnerships with ports through its ships in different countries globally. Now this company is underperforming in terms of its financial growth, which shows that there can be good growth in Seacoast Shipping Stock Price in the coming time.

| Company Name | Seacoast Shipping Services Ltd. |

| Founded | 1982 |

| Headquarters | Ahmedabad, Gujarat |

| Industry | Shipping |

| CEO | Manish Raichand Shah |

| Stock Exchange Listing | BSE |

| Official Website | seacoastltd.com |

Seacoast Shipping Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹205.78 Cr. |

| ROE | 26.04% |

| ROCE | 28.40% |

| P/E | 9.23 |

| P/B | 1.53 |

| Div. Yield | 0% |

| Book Value | ₹2.49 |

| Face Value | ₹1 |

| EPS (TTM) | ₹0.41 |

| 52 Week High | ₹7.49 |

| 52 Week Low | ₹2.53 |

TO LEARN MORE ABOUT THE SHARE MARKET & TRADING, AND TO IMPROVE YOUR INVESTING STRATEGIES

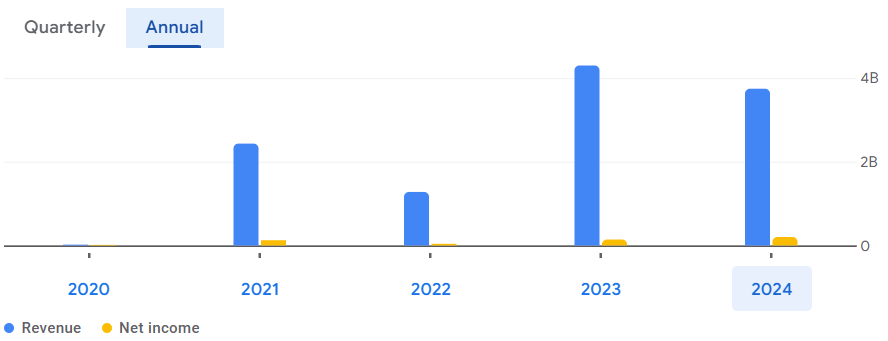

Seacoast Shipping Financials

Income Statement

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 3.74B | -12.90% |

| Operating expense | 11.76M | 62.50% |

| Net income | 202.86M | 42.04% |

| Net profit margin | 5.42 | 63.25% |

| Earnings per share | — | — |

| EBITDA | 351.11M | 13.97% |

| Effective tax rate | 38.72% | — |

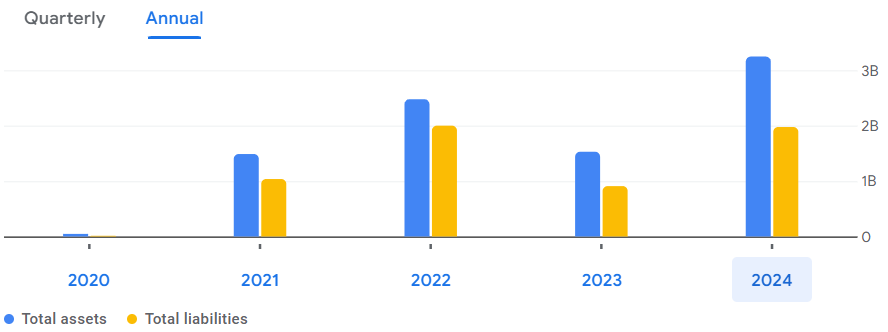

Balance Sheet

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Cash and short-term investments | 147.00K | 3.52% |

| Total assets | 3.25B | 112.38% |

| Total liabilities | 1.97B | 117.30% |

| Total equity | 1.27B | — |

| Shares outstanding | 536.02M | — |

| Price to book | 1.68 | — |

| Return on assets | 9.19% | — |

| Return on Capital | 17.70% | — |

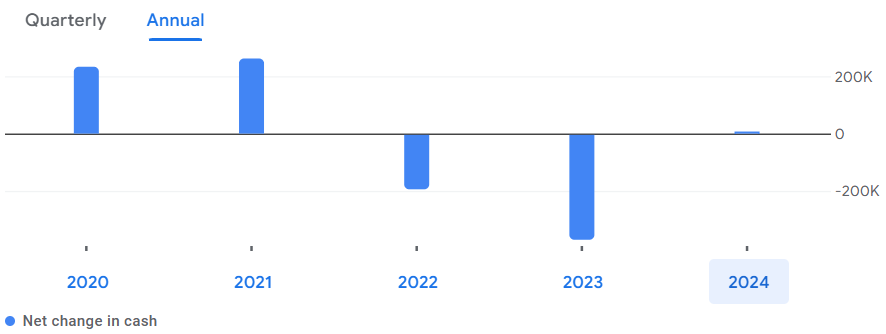

Cash Flow

| (INR) | 2024 | Y/Y Change |

|---|---|---|

| Net income | 202.86M | 42.04% |

| Cash from operations | -447.45M | -1,076.06% |

| Cash from investing | -1.52M | -207.47% |

| Cash from financing | 448.97M | 1,076.06% |

| Net change in cash | 5.00K | 101.37% |

| Free cash flow | -462.78M | -1,984.65% |

Also Read: IREDA Share Price Target

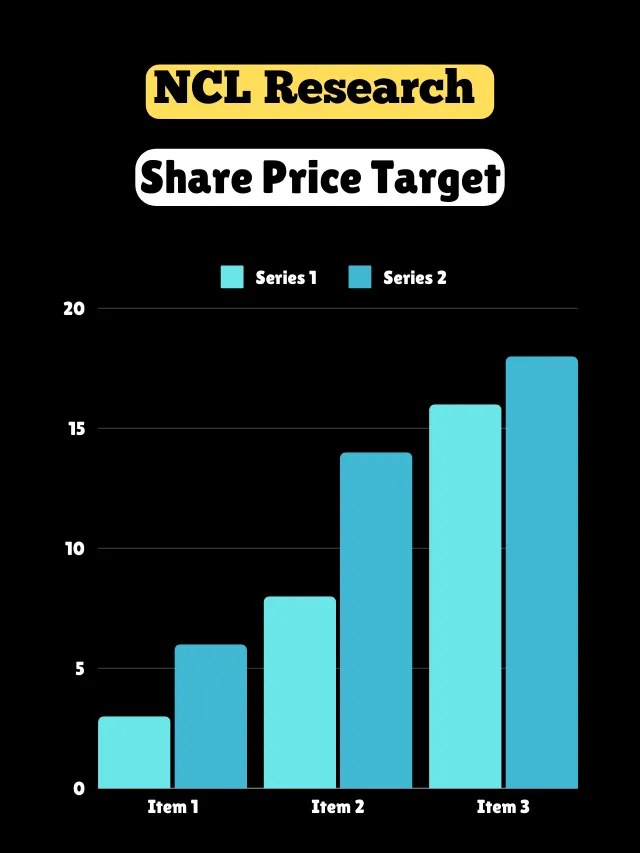

Seacoast Shipping Share Price Target 2024 to 2030

| Year | Target Price |

|---|---|

| Seacoast Shipping Share Price Target 2024 | ₹4.02 |

| Seacoast Shipping Share Price Target 2025 | ₹6.87 |

| Seacoast Shipping Share Price Target 2026 | ₹8.95 |

| Seacoast Shipping Share Price Target 2027 | ₹11.00 |

| Seacoast Shipping Share Price Target 2028 | ₹14.17 |

| Seacoast Shipping Share Price Target 2029 | ₹19.25 |

| Seacoast Shipping Share Price Target 2030 | ₹25.38 |

Seacoast Shipping Share Price Target 2024

The share price will reach around 4.02 INR by the year 2024, provided the company continues to grow at a faster rate than it is growing today, this target can also be crossed.

Seacoast Shipping Share Price Target 2025

By 2025, its share price can be 6.87 INR. This year Seacoast Shipping will try to maintain stability with its business model and new plans. If the company successfully completes its existing projects and strengthens its position in the market, then this can be a year of stable growth for investors.

Seacoast Shipping Share Price Target 2026

The target price of the stock in 2026 can be up to 8.95 INR. The company’s focus will be on its operations and expansion plans. If the company implements its existing strategies correctly and moves forward understanding the market demand, then investors will get good returns at this time.

Seacoast Shipping Share Price Target 2027

By 2027, the effect of the company’s expansion plans and new projects will start showing. If the company enters new markets and gains an edge over the competition, the share price can go up to 11.00 INR. This year could be important for the company and investors can expect good profits.

Seacoast Shipping Share Price Target 2028

The company’s growth rate will accelerate even further in 2028, especially if it expands into new areas and expands the scope of its services. Under these circumstances, the share price is going to be around 14.17 INR.

Seacoast Shipping Share Price Target 2029

Seacoast Shipping’s position could be even stronger in 2029, provided the company continues to achieve its goals. By this year, the share price could reach 19.25 INR. The company’s continued growth and new partnerships could increase its demand in the market.

Seacoast Shipping Share Price Target 2030

By 2030, the company’s share target price could be up to 25.38 INR, as the impact of long-term strategies will become clearly visible. If the company takes its expansion in the right direction and the stable financial performance continues, then this year can provide investors with an opportunity to invest for the long term.

Also Read: IIFL Finance Share Price Target

Seacoast Shipping Shareholding Pattern

- Retail & Other: 99.96%

- Promoters: 0.04%

- Foreign Institution: —

- Mutual Funds: —

- Other Domestic Institutions: —

Seacoast Shipping Competitors

- Essar Shipping

- ABS Marine Services

- Global Offshore Services

- Sadhav Shipping

- Varun Shipping Company

- Arvind Ship Agencies

- Chowgule Steamships

- Shahi Shipping

- Mercator

Also Read: Vodafone Idea Share Price Target

Seacoast Shipping Ltd Share Price Factors

- Revenue Growth: The company is increasing its growth with a very good consistency and along with that the demand for services is also increasing. More and more customers are coming to them for shipping their products, so investors have more confidence in this company and Seacoast Shipping Share Price can go up in the coming time.

- Profit Margin: This company is also improving its profitability, as well as trying to reduce the cost on operational margin as much as possible. Seeing the revenue growth in this company and mostly seeing the average industry revenue growth of the company, investors have gained confidence in this company.

- Adoption Technology: The company is growing by using advanced technology such as securing its transactions with the help of Blockchain Technology, real-time cargo tracking with the help of Information Technology and also optimizing and improving its routes with the help of AI so that it can reduce its operational efficiency budget.

Also Read: Indian Infotech Share Price Target

Seacoast Shipping Services

- Freight Forwarding: Through this, the company provides you with a hand-to-hand solution for any good, so that you can send any of your goods on time to the international market.

- Vessel Charting: If you need long-term and short-term transportation to deliver goods to any country through a water ship, then you can use vessel charting.

- Ship Management: To deliver a ship, it is very important to have management inside it, you have to look after the operation of the whole day and also look after the crew management and take care of its maintenance and regulations compliance etc.

- Logistic Solution: This company gives you many logistics solution providers in which it provides facilities like inland transportation, cargo handling and storage.

Risk & Opportunity

Opportunity

- A lot of global export is happening within India, due to which most of the customers of this company are dependent on this shipping company to deliver their goods to foreign countries. In such a market, this company is earning a lot of profit and this is a very good opportunity for the company.

Risk

- Most shipping companies see a lot of fluctuation in their profit margin regarding fuel price because this price depends on the country from where the raw oil is procured, then it is prepared for use in the shipping industry, this causes a lot of problems to the company.

- As we know at the time of COVID-19, business was closed in the whole country and at the same time, due to natural disasters and geo-political tension, a lot of loss has to be seen in the Supply Chain Business.

Also Read: RVNL Share Price Target

Conclusion

See, along with knowing about Seacoast Shipping Share Price Target, it is also very important to understand other things about the company. If you want to know about the Share Price Target of many different companies, then you can connect with us on WhatsApp or Telegram.

To connect with us, click on the given Facebook or WhatsApp button.

FAQs

-

Is it good to buy Seacoast Shipping share?

Yes.

-

Can I buy Seacoast Shipping shares?

Yes.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company.