Zensar Technologies Share Price: Zensar Technologies Limited, a provider of IT services and seller of IT-related products, operates within the Technology sector in the Information Technology Services industry.

The company’s two main divisions are Digital and Application Services (DAS) and Digital Foundation Services (DFS).

The largest revenue is generated by the DAS division, which focuses on custom application management services, including application development, maintenance, support, modernization, and testing services across all technology areas and industry sectors.

Zensar Technologies Company Overview

| Company Name | Zensar Technologies Ltd. |

| Founded | 1991 |

| Headquarters | Pune, Maharashtra |

| Industry | IT |

| MD | Manish Tandon |

| Stock Exchange Listing | NSE & BSE |

| Official Website | zensar.com |

Zensar Technologies Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹18,995.31 Cr. |

| ROE | 19.36% |

| ROCE | 25.80% |

| P/E | 33.87 |

| P/B | 6.49 |

| Div. Yield | 1.05% |

| Book Value | ₹129.03 |

| Face Value | ₹2 |

| EPS (TTM) | ₹24.71 |

| 52 Week High | ₹839.50 |

| 52 Week Low | ₹515 |

Also Read: Hindalco Share Price Target

Zensar Technologies Financials

Income Statement

| INR | 2024 | Y/Y Change |

|---|---|---|

| Revenue | 49.02B | 1.11% |

| Operating Expense | 3.75B | -17.04% |

| Net Income | 6.65B | 102.99% |

| Net Profit Margin | 13.57 | 100.74% |

| Earnings Per Share | 29.13 | 102.29% |

| EBITDA | 8.32B | 71.01% |

| Effective Tax Rate | 24.07% | — |

Balance Sheet

| INR | 2024 | Y/Y Change |

|---|---|---|

| Cash and Short-term Investments | 13.73B | 17.07% |

| Total Assets | 46.48B | 12.78% |

| Total Liabilities | 10.86B | -5.15% |

| Total Equity | 35.62B | — |

| Shares Outstanding | 226.63M | — |

| Price to Book | 4.77 | — |

| Return on Assets | 10.63% | — |

| Return on Capital | 13.33% | — |

Cash Flow

| INR | 2024 | Y/Y Change |

|---|---|---|

| Net Income | 6.65B | 102.99% |

| Cash from Operations | 6.42B | -10.11% |

| Cash from Investing | -4.75B | 9.93% |

| Cash from Financing | -1.97B | 9.84% |

| Net Change in Cash | -312.00M | -0.65% |

| Free Cash Flow | 5.34B | 1.31% |

Also Read: Schneider Electric Share Price Target

Zensar Technologies Share Price – Target 2025 to 2030

| Year | Target Price |

|---|---|

| Zensar Technologies Share Price Target 2025 | ₹1400 |

| Zensar Technologies Share Price Target 2026 | ₹1604 |

| Zensar Technologies Share Price Target 2027 | ₹1853 |

| Zensar Technologies Share Price Target 2028 | ₹2120 |

| Zensar Technologies Share Price Target 2029 | ₹2431 |

| Zensar Technologies Share Price Target 2030 | ₹2782 |

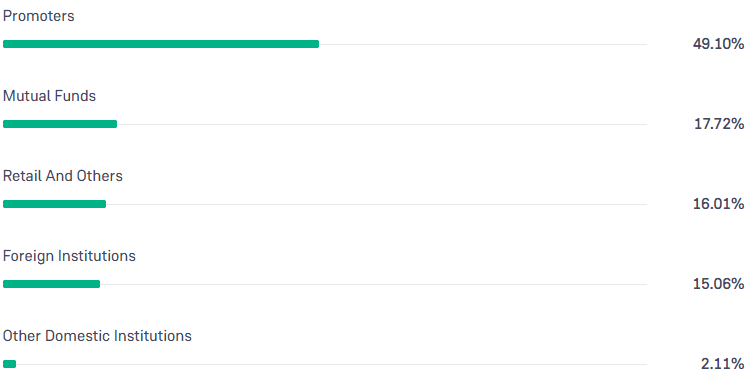

Zensar Technologies Shareholding Pattern

- Retail & Other: 16.01%

- Promoters: 49.10%

- Foreign Institutions: 15.06%

- Mutual Funds: 17.72%

- Other Domestic Institutions: 2.11%

Also Read: Oberoi Realty Share Price Target

Zensar Technologies Competitors/Peer Companies

- OFSS – Oracle Financial Services Software

- PolicyBazaar

- Coforge

- Tata ElxsI

- KPIT Technologies

- Tata Technologies

- Affle India

- Cyient Ltd

- Newgen Software Tech

- Sonata Software

Also Read: Persistent Systems Share Price Target

To connect with us, click on any of the given social media buttons.

Disclaimer: The information in this blog is for educational purposes only, and the targets mentioned in it are given as suggestions by market analysts. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

I am a seasoned stock market expert who specializes in analyzing India’s economic indicators and their impact on listed companies. My market forecasts are based on macroeconomic insights, corporate earnings, and sector performance. I am known for offering practical and reliable predictions for retail and institutional investors alike.