IREDA Share Price Target: As in today’s time, the government is encouraging the people of the country a lot regarding Indian renewable energy and is also providing subsidies for this. In such a situation, if you are an investor, it has become very important to know the IREDA shares trend of different years and understand how much its price can go up in the coming few years (2025, 2026-2030).

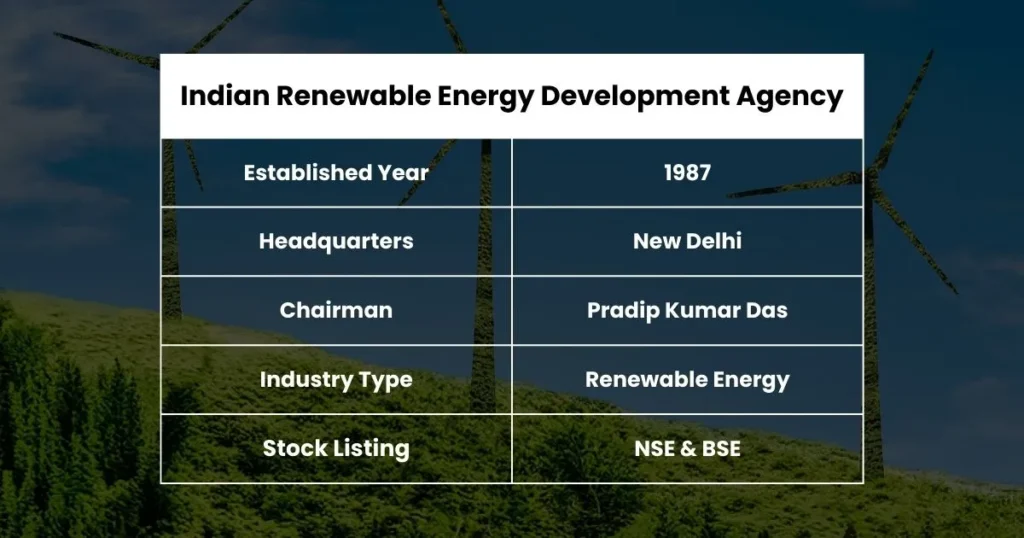

Join Us On WhatsApp GroupIndian Renewable Energy Development Agency (IREDA) Company Overview

IREDA was formed under the Company Act 1956, while it was established in 1987. For your information, let us tell you that it is monitored by the Ministry of New and Renewable Energy.

IREDA plays a very important role in the renewable energy sector. There are a total of 2700 IREDA Renewable Energy Projects in it, which contribute to generating 18000 megawatts of energy capacity, due to which energy is delivered to people in different places through green energy sources.

Every year, several million tons of energy are produced and reach different villages and towns, where you can generate electricity without any pollution.

IREDA Fundamental Analysis

- Market Cap: ₹46,699.91 Cr.

- ROE: 17.28%

- ROCE: 9.29%

- P/E Ratio: 30.44

- P/B Ratio: 4.78

- Div. Yield: 0%

- Book Value: ₹36.32

- Face Value: ₹10

- EPS (TTM): ₹5.71

- 52-Week High: ₹310

- 52-Week Low: ₹121.05

Also Read: iIDFC First Bank Share Price Target

IREDA Share Price Target 2025

After analyzing IREDA’s past price trends and market performance, it is estimated that the stock could reach ₹180.28 by early 2025.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹270.36.

By the end of 2025, IREDA’s share price can achieve the target of ₹310.21.

| Month | Target Price |

|---|---|

| January | ₹221.76 |

| February | ₹202.11 |

| March | ₹156.60 |

| April | ₹180.28 |

| May | ₹205.75 |

| June | ₹230.42 |

| July | ₹252.89 |

| August | ₹270.36 |

| September | ₹285.19 |

| October | ₹295.78 |

| November | ₹305.24 |

| December | ₹310.21 |

IREDA Share Price Target 2026

After analyzing IREDA’s past price trends and market performance, it is estimated that the stock could reach ₹320.48 by early 2026.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹440.72.

By the end of 2026, IREDA’s share price can achieve the target of ₹550.63.

| Year 2026 | Target Price |

|---|---|

| Beginning | ₹320.48 |

| Middle | ₹440.72 |

| End | ₹550.63 |

IREDA Share Price Target 2027

After analyzing IREDA’s past price trends and market performance, it is estimated that the stock could reach ₹570.81 by early 2027.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹610.43.

By the end of 2027, IREDA’s share price can achieve the target of ₹640.35.

| Year 2027 | Target Price |

|---|---|

| Beginning | ₹570.81 |

| Middle | ₹610.43 |

| End | ₹640.35 |

Also Read: Samvardhana Motherson Share Price Target

IREDA Share Price Target 2028

After analyzing IREDA’s past price trends and market performance, it is estimated that the stock could reach ₹660.47 by early 2028.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹705.28.

By the end of 2028, IREDA’s share price can achieve the target of ₹750.96.

| Year 2028 | Target Price |

|---|---|

| Beginning | ₹660.47 |

| Middle | ₹705.28 |

| End | ₹750.96 |

IREDA Share Price Target 2029

After analyzing IREDA’s past price trends and market performance, it is estimated that the stock could reach ₹765.32 by early 2029.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹840.18.

By the end of 2029, IREDA’s share price can achieve the target of ₹890.74.

| Year 2029 | Target Price |

|---|---|

| Beginning | ₹765.32 |

| Middle | ₹840.18 |

| End | ₹890.74 |

IREDA Share Price Target 2030

After analyzing IREDA’s past price trends and market performance, it is estimated that the stock could reach ₹920.52 by early 2030.

By the middle year, driven by market demand and sector performance, the price could rise to around ₹1,000.36.

By the end of 2030, IREDA’s share price can achieve the target of ₹1,060.89.

| Year 2030 | Target Price |

|---|---|

| Beginning | ₹920.52 |

| Middle | ₹1,000.36 |

| End | ₹1,060.89 |

IREDA Share Price Target & Forecast 2025 to 2030

| Year | Target Price |

|---|---|

| 2025 | ₹310.21 |

| 2026 | ₹550.63 |

| 2027 | ₹640.35 |

| 2028 | ₹750.96 |

| 2029 | ₹890.74 |

| 2030 | ₹1,060.89 |

Also Read: Alstone Textiles Share Price Target

Factors Affecting The IREDA Stock Price

It is very important for an investor to understand the following factors that impact IREDA’s share price:

1. Government Policies

The Indian government plays a key role in building the renewable energy sector.

- Renewable Energy Goals: The government has set ambitious targets for renewable energy, including achieving 500 GW of non-fossil fuel capacity by 2030. Successful progress towards these targets will positively impact IREDA’s share price.

- Incentives and Subsidies: Financial incentives for renewable energy projects, such as tax breaks and subsidies, can increase the viability of IREDA projects. This will lead to an increase in share prices.

- Regulatory Environment: Changes in regulations regarding renewable energy can impact IREDA’s operations. A stable and supportive regulatory framework can attract more investments and boost share prices, while the opposite can have the opposite effect.

2. Economic Indicators

- Interest rates: Fluctuations in interest rates can affect the cost of borrowing for companies, including those in the renewable energy sector. Lower interest rates generally spur investment, while higher rates can deter it, which could impact IREDA’s funding and project development.

- Inflation: Rising inflation can reduce purchasing power and increase operational costs for businesses. For IREDA, this could mean that the cost of financing renewable energy projects will rise, which could impact profitability and share price.

- GDP growth: A growing economy generally drives up energy demand and investment in infrastructure, including renewable energy.

3. Competition in the Renewable Energy Sector

The renewable energy sector is becoming increasingly competitive, involving both public and private players.

- Market share: If IREDA establishes itself as a leader in renewable energy projects, this could lead to positive value potential.

- Innovation and technological advancement: Increasing new technologies can disrupt the market. If IREDA performs well in this, it can expand its project offerings and maintain investor interest, which could lead to an increase in the share price.

4. Global Trends in Renewable Energy Investments

- International agreements: Commitments to climate change, such as the Paris Agreement, can boost global investment in renewable energy. As countries try to fulfil their promises, demand for financing from IREDA may increase, which will positively impact the share price.

- Foreign investment: Growing foreign direct investment (FDI) in India’s renewable energy sector could enhance IREDA’s funding capabilities. Increased international interest could lead to a rise in share prices.

- Market sentiment: Global market sentiment towards renewable energy could impact domestic stocks. The sentiment of positivity around sustainability and clean energy could boost IREDA’s share price if it aligns with broader environmental goals.

Also Read: Tata Technologies Share Price Target

IREDA Shareholding Pattern

- Retail & Other: 22.51%

- Promoters: 75.00%

- Foreign Institution: 1.85%

- Mutual Funds: 0.28%

- Other Domestic Institution: 0.36%

IREDA Share Price Target FAQ

Is IREDA profitable?

Yes, IREDA is profitable.

Is IREDA undervalued or overvalued?

IREDA is Overvalued.

Is IREDA a monopoly?

Yes, IREDA is a monopoly.

What is the target price of IREDA in 2025?

The target price of IREDA in 2025 is ₹310.21

What is the target price of IREDA in 2030?

The target price of IREDA in 2025 is ₹1,060.89

Also Read: Infibeam Share Price Target

Disclaimer: The information in this article is for educational purposes only, and market analysts give the targets mentioned in it as suggestions. Therefore, before investing your money in any company, it is mandatory to get complete information about the company and consult your financial advisor.

Disclaimer: The stock market updates shared by DateUpdateGo are solely for general information and learning purpose only. They are not meant to serve as an investment advice. Individuals should always seek guidance from a certified financial advisor before making any investment-related choices.